Markets Decline. Then They Rebound

The market unease that began early this year has intensified.

Many equity markets around the world are in a correction (down 10% or more) and, in some regions and sectors, markets entered bear market territory (down over 20%). How does this compare to history? Market drawdowns are not rare. There have been 16 since 1960 (more than 1 every 4 years). Among them, 7 became bear markets.

Long-term investors should be able to manage through market gyrations.

It’s hard to say when the markets will find the bottom. Based on the averages we are either in the middle or near the end of this downturn. But drawdowns have ranged from just 2 months to 25 months (bursting of the tech bubble), making it difficult, if not impossible, to time exit and re-entry points.

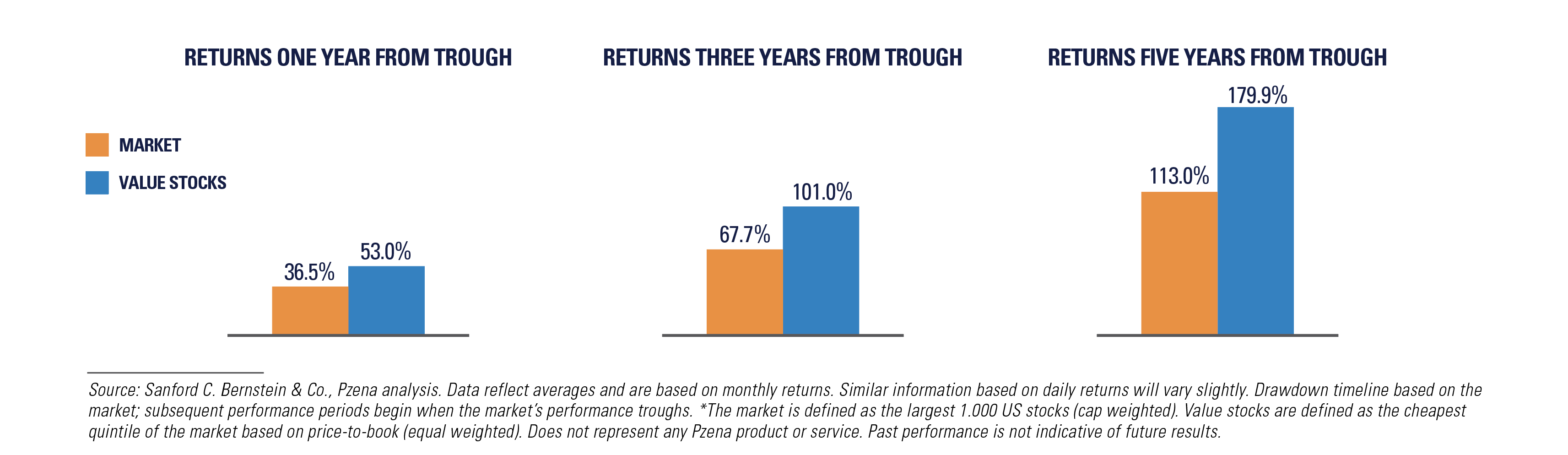

Importantly, markets tend to rebound quickly off the bottom. Below we display the average cumulative returns following the 16 drawdowns. Investors who stay in equities and take the long view with a proper value exposure have historically been well rewarded during turbulent times.

Co-CIO John Goetz touches on uncertainty — the quick, fearful response and the recovery of hope that typically sets the stage for strong value-stock returns-in our recent podcast.

Listen to podcast here: https://www.pzena.com/value-investing-the-recovery-of-hope/