The energy sector is controversial. It faces a perfect storm due to the short-term demand shock caused by the COVID-19 pandemic and the longer-term risk from the reduction in society’s carbon footprint to combat climate change. Considering this uncertainty and the collapse

in valuations in the sector, we are confronted with dual scenarios: whether the sector presents an exceptional investment opportunity or is destined for obsolescence. We believe the key questions are:

- What is the risk that energy companies will be left with material stranded assets in a carbon-neutral world?

- How will the coming energy transition impact the sustainability of energy companies?

This note focuses on the risks and opportunities presented by the upcoming transition for the energy sector. We address company-specific issues as part of our research framework that is bottom-up and fully integrates ESG concerns unique to each company. The details of Pzena’s integrated ESG framework are available upon request.

ASSET LIQUIDATION VALUES AND RISK OF STRANDED ASSETS

In all resource extraction businesses, metrics such as price to earnings are misleading because they do not account for the natural depletion of the underlying assets, i.e., oil and gas reserves. Instead, it makes sense to price these companies based on the liquidation of their reserves given their limited franchise value. We know a great deal about how to make such an estimate. We know the total quantity of reserves. We know the future production and cost profiles. We can therefore compute the value of the company’s reserves at a given oil price. If the future price of oil that is embedded in the market’s current value of reserves is irrational, we can buy or sell the stock. For a company’s reserves to become stranded or obsolete, either I) the total supply of reserves must exceed likely future demand, or II) new competition with a significant cost advantage makes the exploitation of this incumbent’s reserves uneconomical. We see both scenarios as unlikely.

- Publicly-traded oil and gas companies have reserves that can typically be produced in a matter of years (usually in the single to low double digits), whereas iron-ore and copper reserves are often measured in decades or even centuries. This means that at current production rates, under all scenarios for future oil demand, it is impossible for upstream reserves to become obsolete due to inadequate demand for oil.

- With respect to new competitors, US shale has emerged as a powerful new supply source over the past few years. But we estimate that US shale production requires an oil price of $60 per barrel or more to be economical, underscoring the limits as to how much disruption shale can cause.

MULTI-DECADE DEMAND FOR OIL AND GAS

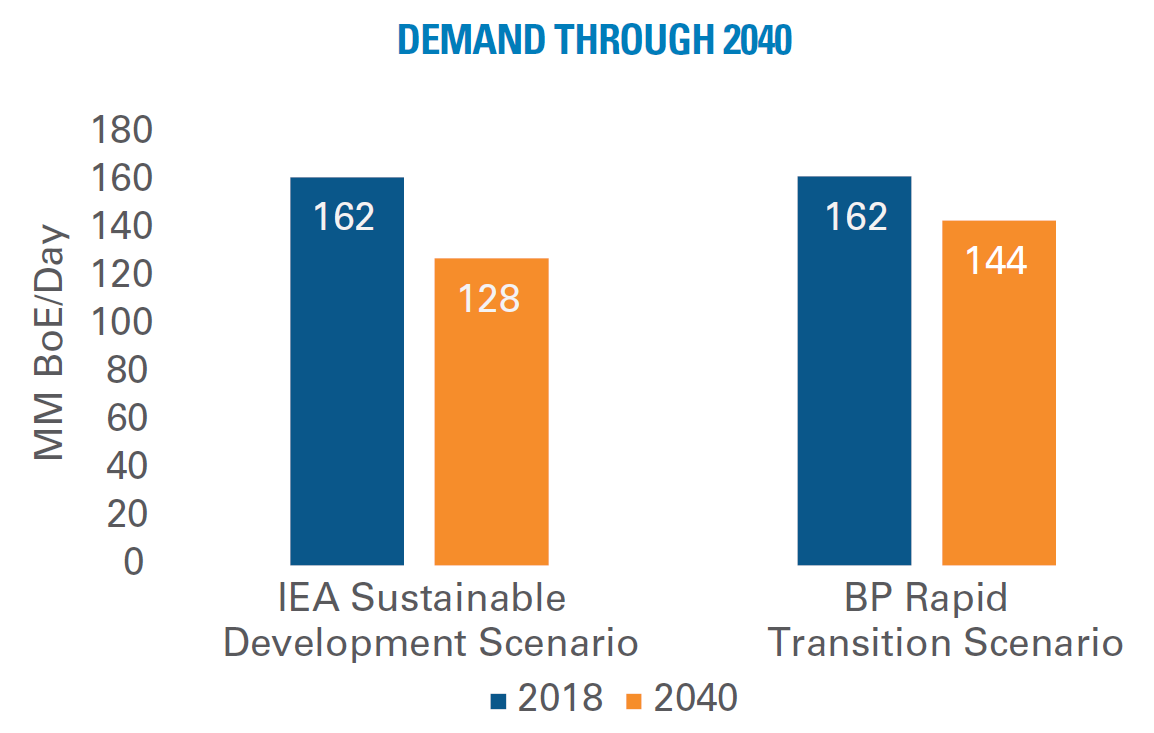

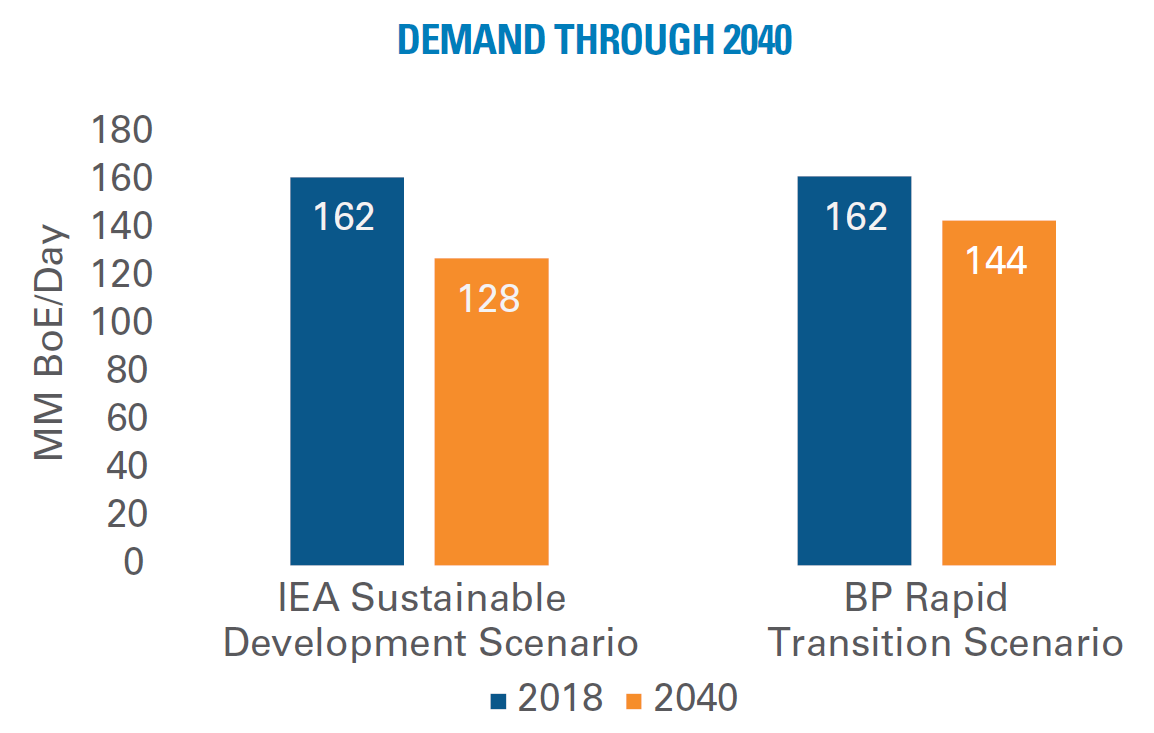

It bears repeating that there is no scenario under which the demand for oil and gas will disappear in the next few decades. We see overall demand peaking in about 10 years and declining only slowly after that. Consider the long-range scenarios run by the International Energy Agency and BP p.l.c., to limit the rise in global temperatures to materially below 2°C by 2040 (Figure 1) that show overall demand for oil and gas to be lower than 2018 by 21% (IEA) or 11% (BP) by then. Meeting these long-range scenarios will be challenging without a significant shift in energy policies around the world.

Figure 1: There Will Be Demand for Oil and Gas for Many Decades to Come

Source: International Energy Agency; BP p.l.c.

Source: International Energy Agency; BP p.l.c.

Measured in millions of barrels per day

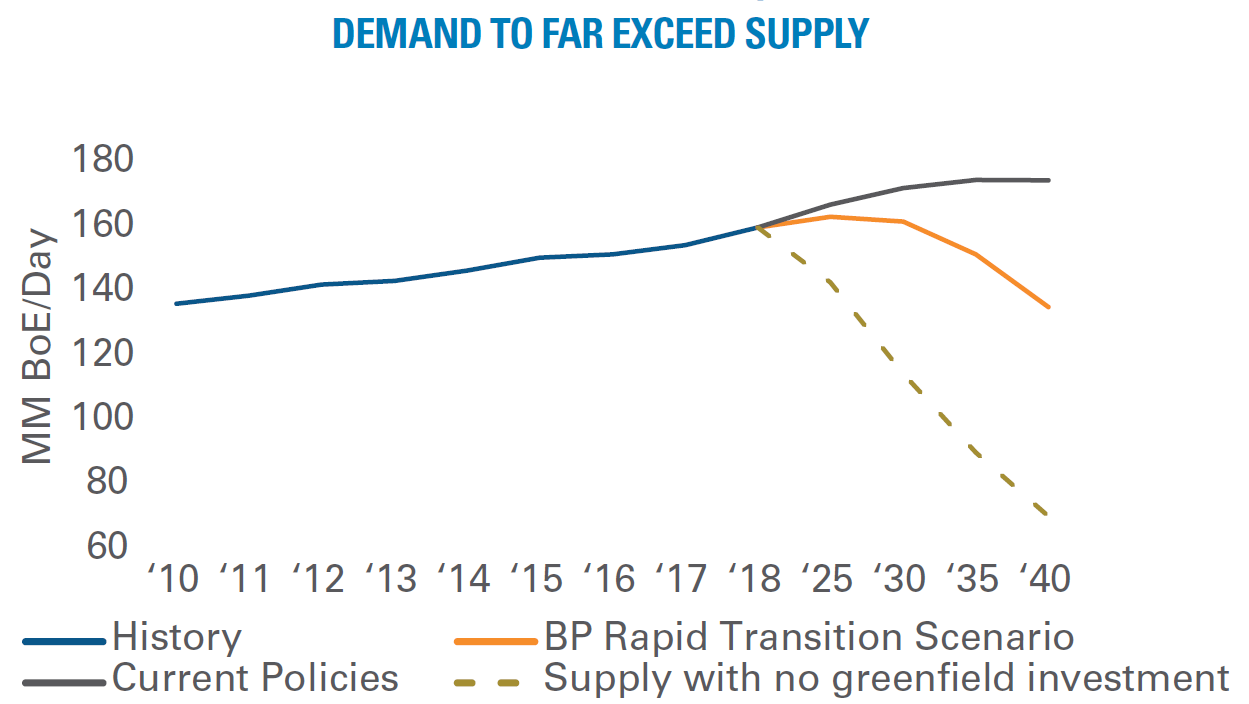

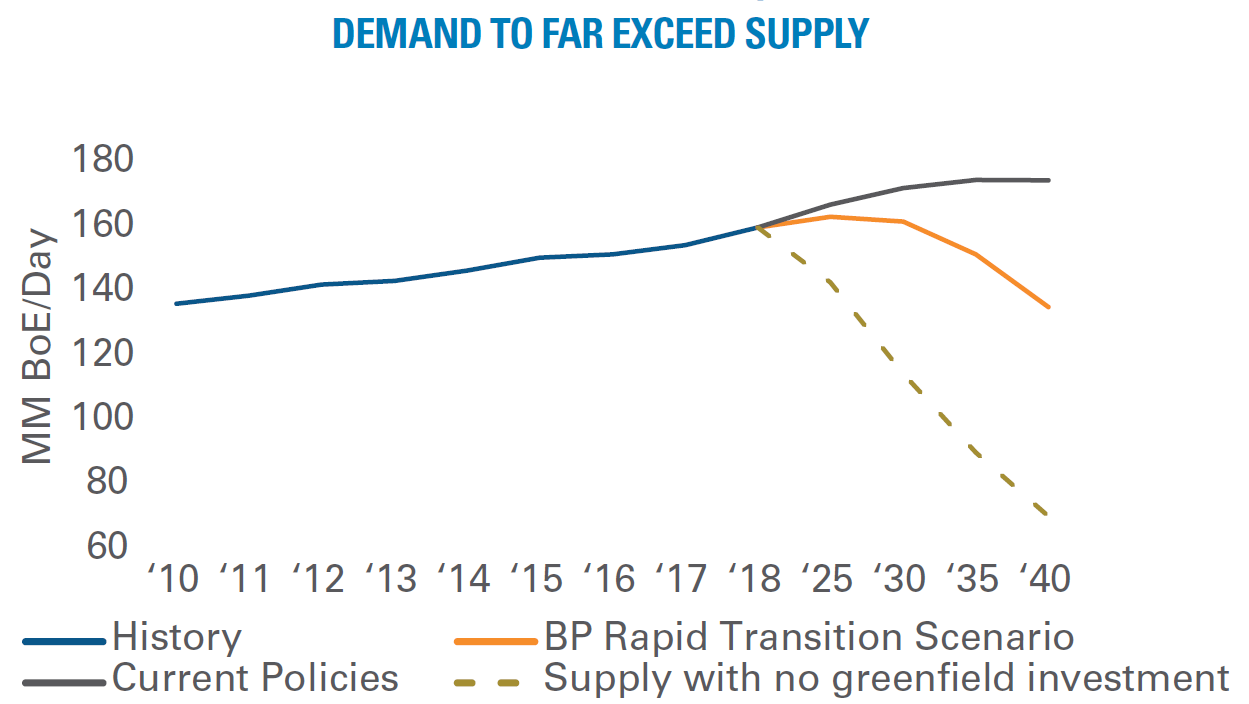

The gravity of the supply shortfall is illustrated in Figure 2. The grey line reflects current and estimated future demand levels under today’s policy regime, whereas the orange line illustrates the BP scenario, which is among the most aggressive. However, with no new investment and the 5%–8% drop-off in the natural rate of production, supply is unlikely to meet demand under all scenarios as shown by the dashed line. So, material new investment will be needed to meet future oil and gas demand; BP estimates that somewhere between $9 trillion and $20 trillion will be necessary to meet demand through 2050.

Figure 2: New Production Needed Even in a Rapid Transition Scenario

Source: International Energy Agency; BP p.l.c.

Source: International Energy Agency; BP p.l.c.

Measured in millions of barrels per day

This need for investment implies that oil prices must be sufficient enough to allow companies to fund this investment and earn an adequate rate

of return. We believe that such a level needs to be between $50 and $70 per barrel in today’s dollars. Interestingly, the average oil price over the last 50 years has been right in the middle of this range ($60), despite sharp, periodic, short-term volatility. The current share prices of oil and gas producers underestimate the future investments required to meet global demand.

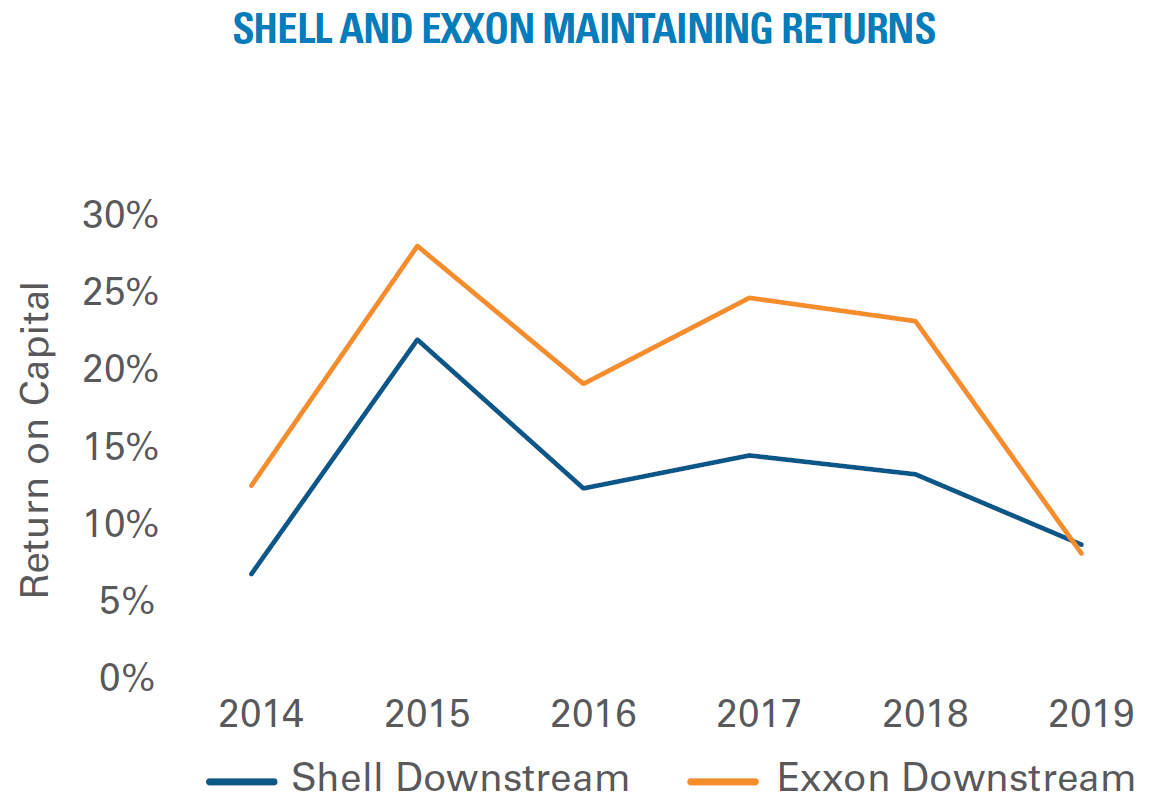

Downstream Refining and Petrochemicals

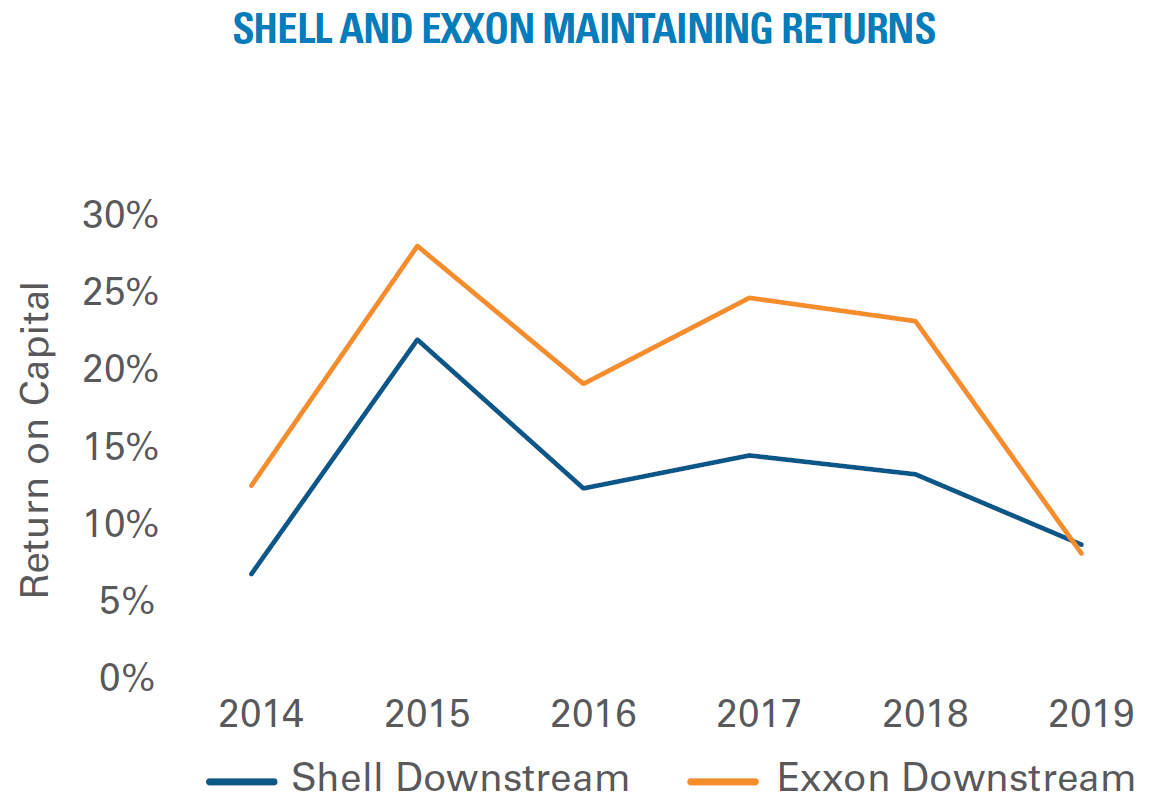

With useful lives of 30–40 years, downstream asset values are more sensitive to long-term demand changes. On the refining side, the rapid transition to electric vehicles in Europe leaves a considerable risk of stranded assets. In petrochemicals, concerns over single-use plastics present a modest headwind to demand growth over time. However, assets should remain valuable depending on their cost advantages and value-added product portfolios. This segment is serving global end markets and continues to enter new growth areas. (Plastic has been a key component of innovation.) Energy companies have been pivoting their downstream investments to reflect these trends. For example, European refineries account for only 30%–35% of the refining capacity of both Exxon and Shell. And motor gasoline composes only around 23% of the oil products sold in Europe for Exxon compared to 58% in North America. Notwithstanding the challenging environment for these businesses over the past few years, their returns on investment remain relatively robust as seen in the figure below.

Figure 3: Near Double-Digit Returns Despite a Tough Landscape

Source: Company reports

Source: Company reports

Oil Service

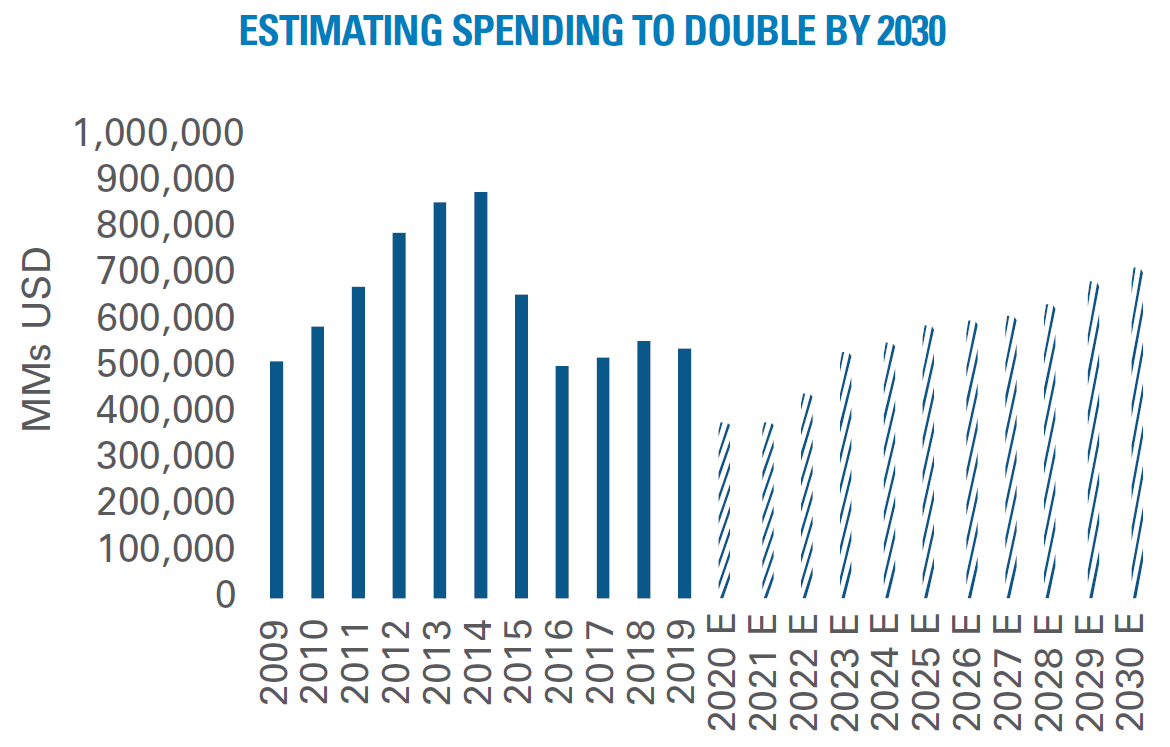

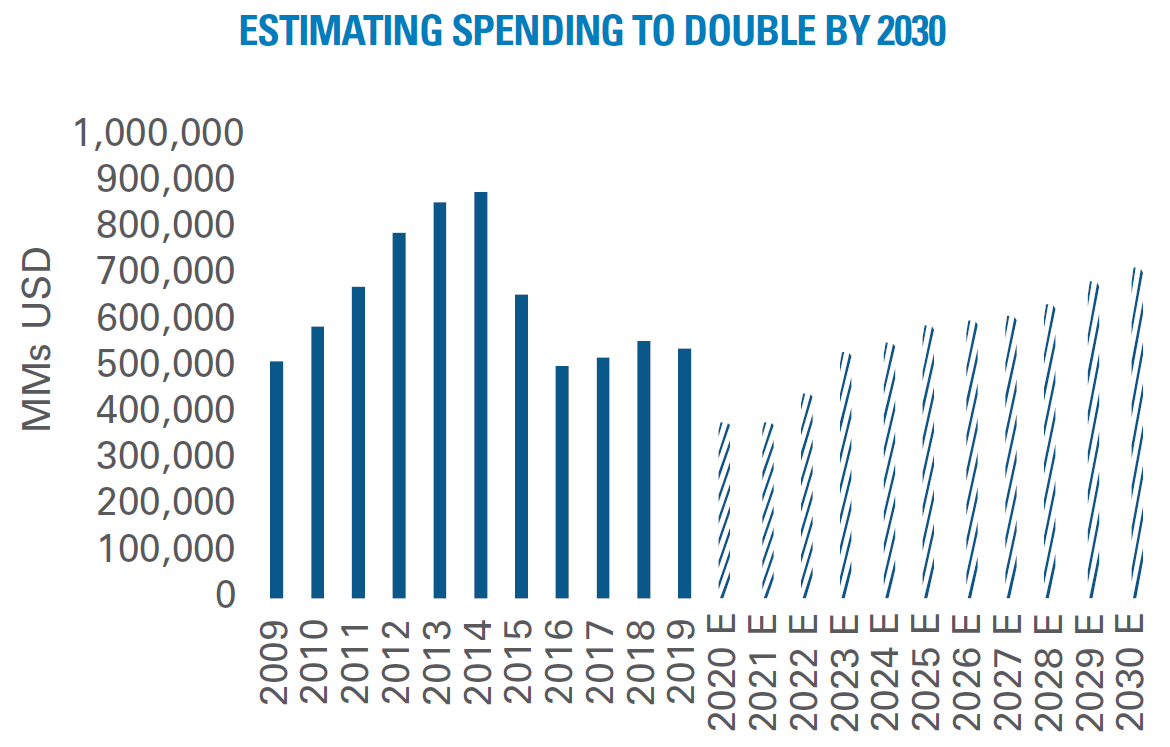

To reiterate, even the most conservative oil demand forecasts require over $9 trillion dollars of spending to extract hydrocarbons over the coming decades. This is driven by the need to replenish and develop reserves to offset the natural rate of decline in oil and gas production. And because the current reserves of oil and gas companies support only 10-12 years of production, oil services will be needed for decades to support this effort. But because there will be differences in the sustainability of business models in the sector, investment selectivity is key.

Figure 4: The Coming Capex Recovery: A Boon for Oil Services?

Source: Rystad

Source: Rystad

Rystad Energy, a leading energy consulting firm, believes that industry capital expenditures have bottomed in 2020 and are poised for significant growth over the coming decade. (See Figure 4.)

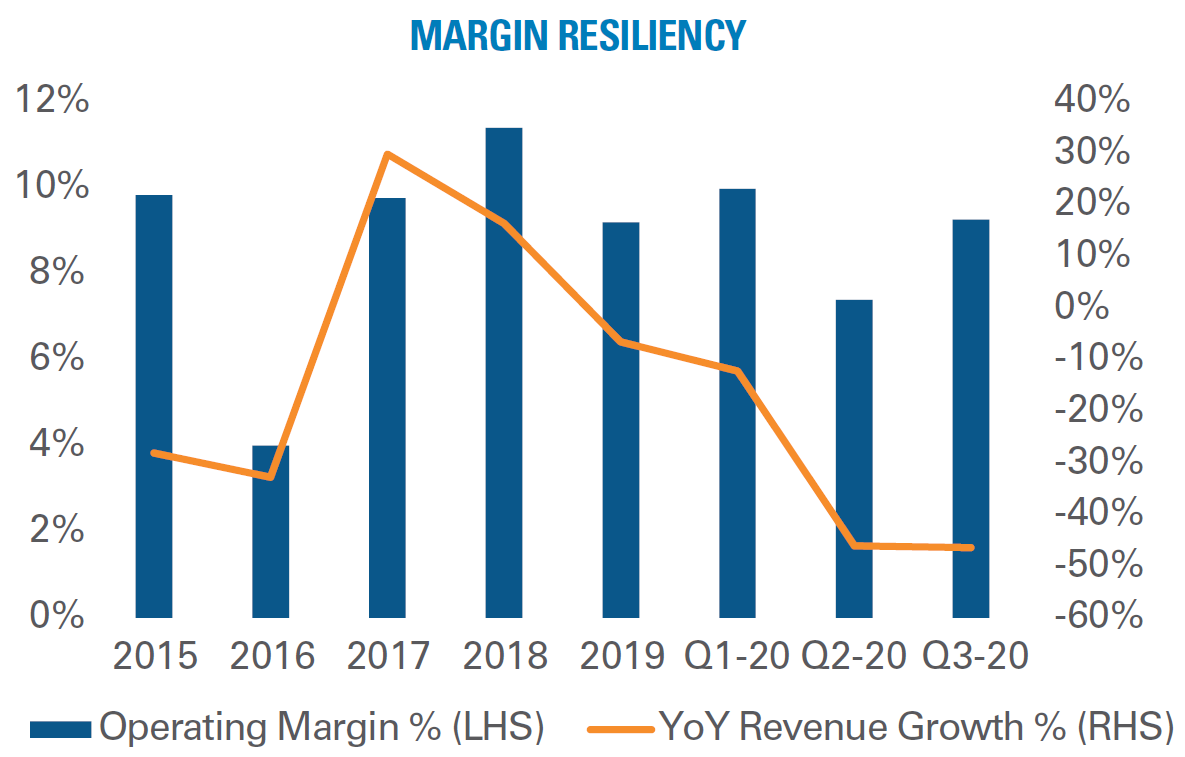

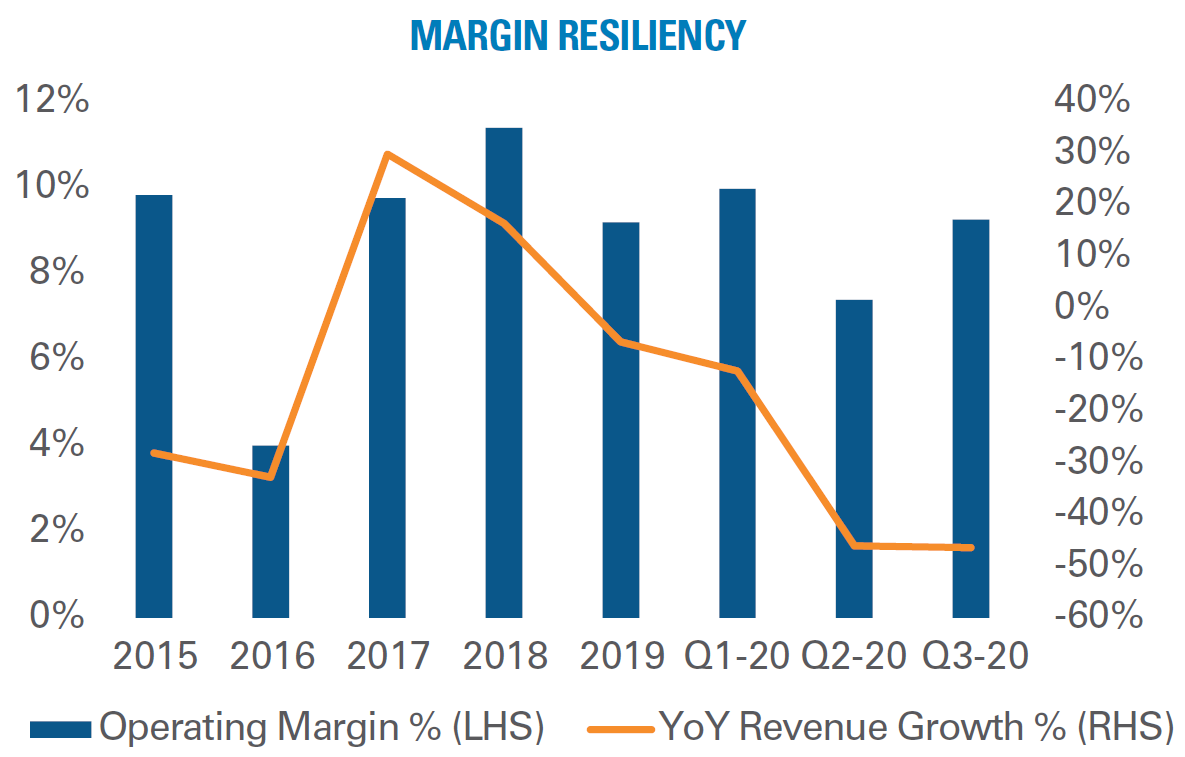

Asset intensity in oil services varies widely. For example, offshore drillships are long-duration assets and highly susceptible to stranded asset risk; pressure-pumping trucks wear down in just a few years, so their asset base and profits adjust to shifting demand very quickly. Moreover, most of the oil service companies have relatively flexible cost structures that they can adjust to varying demand conditions quickly to preserve profitability. (See Figure 5.) Halliburton has exhibited this kind of resiliency and maintained margins in the high single digits amid sharply lower revenues in the current downturn.

Despite meaningful differences in oil service business models and asset and customer bases, there’s little differentiation in valuations. For the select few franchises that have been able to manage their profitability and cashflow in the downturn, the coming activity increase should offer significant opportunities. Even after the recent stock price recovery, valuations still do not reflect the extent of the rebound in activity needed to meet ongoing energy demand over the next few decades.

Figure 5: Halliburton’s Robust and Flexible Business Model

Source: Company Reports and Citi Research

Source: Company Reports and Citi Research

SOME TRANSITION PLANS ARE SOUND—OTHERS AREN’T

As demand declines for traditional fossil fuels and increases for renewables, arithmetic suggests that the long-term investment outcome depends less on when oil demand will peak (whether in 2025 or 2035) and more on what companies are doing in response. How are they deploying the massive cashflow generated from their current reserves? What are the prospects for generating good returns from the new plans or investments?

We answer these questions by making three observations:

- Not all transition plans are created equal.

- Opportunity is not priced in.

- Engage, don’t divest.

1. Not all transition plans are created equal.

The opportunity to select from multiple energy sources (e.g., oil, natural gas, wind, solar, etc.) for reinvestment contrasts sharply with the last century when coal, then oil, dominated the landscape. As a result, meaningful strategy differences are emerging among companies. For example, European and US integrated oil companies have reacted differently to the transition, with those in Europe favoring renewables and those in the US focusing on short-cycle shale or conventional projects. Returns in new energy sources are likely to lag those of traditional sources, given lower technological and scale barriers to entry (localized competition, less challenging geology, etc.) and a perceived lower cost of capital.

The goal of the energy transition can be more easily met when capital flows to technological innovations that lower the cost of new energy sources and, thus, accelerate adoption. In some cases, traditional energy companies create transition plans that slow the pace of innovation by misallocating capital to projects where they don’t have a competitive advantage. In these circumstances, shareholders would be better served to receive the enormous cashflow generated by the liquidation of fossil fuel reserves and reallocate it themselves. Investors should be given the choice to fund the best innovator in new energy source development rather than rely on the discretion of incumbent managements that lack expertise in such emerging areas.

2. Opportunity is not priced in.

Closing the gap between current activity and carbon emission goals will require a wide range of solutions. We see the chance for incumbents to advance these efforts by leveraging their existing capabilities. These opportunities are not reflected in today’s valuation:

- Offshore wind: Installation of scaled offshore wind projects play to the expertise of existing offshore oilfield service providers.

- Blue hydrogen and carbon capture: Large-scale, complex engineering projects are the natural domain of oil and gas majors. Engineering and construction focused oil services companies can design and construct facilities.

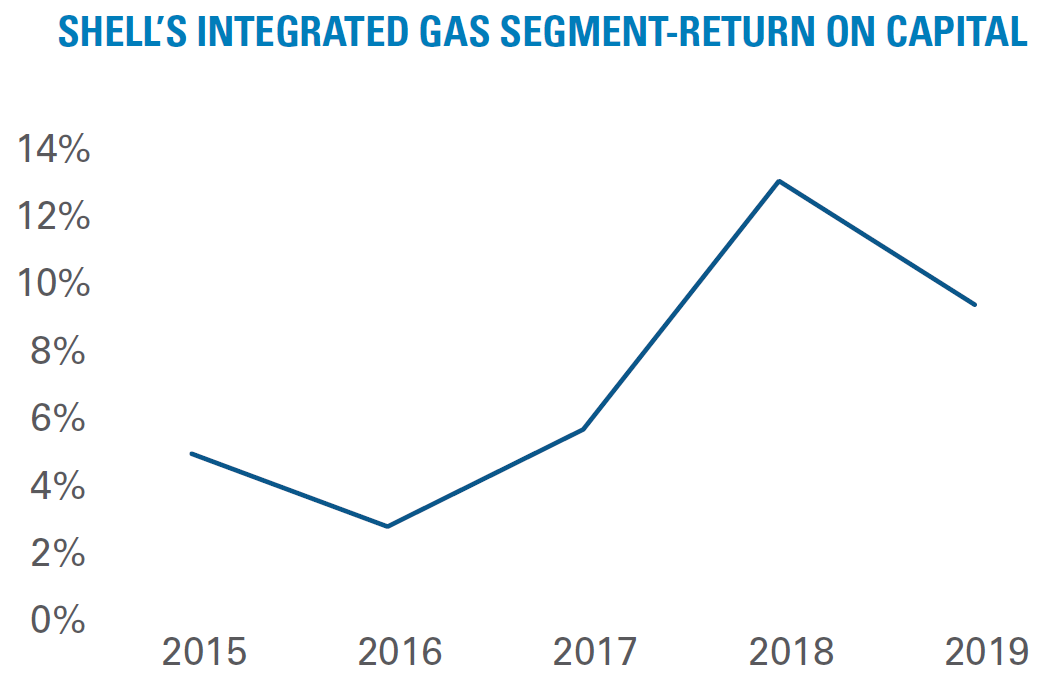

INTEGRATED GAS AT SHELL GLOBAL

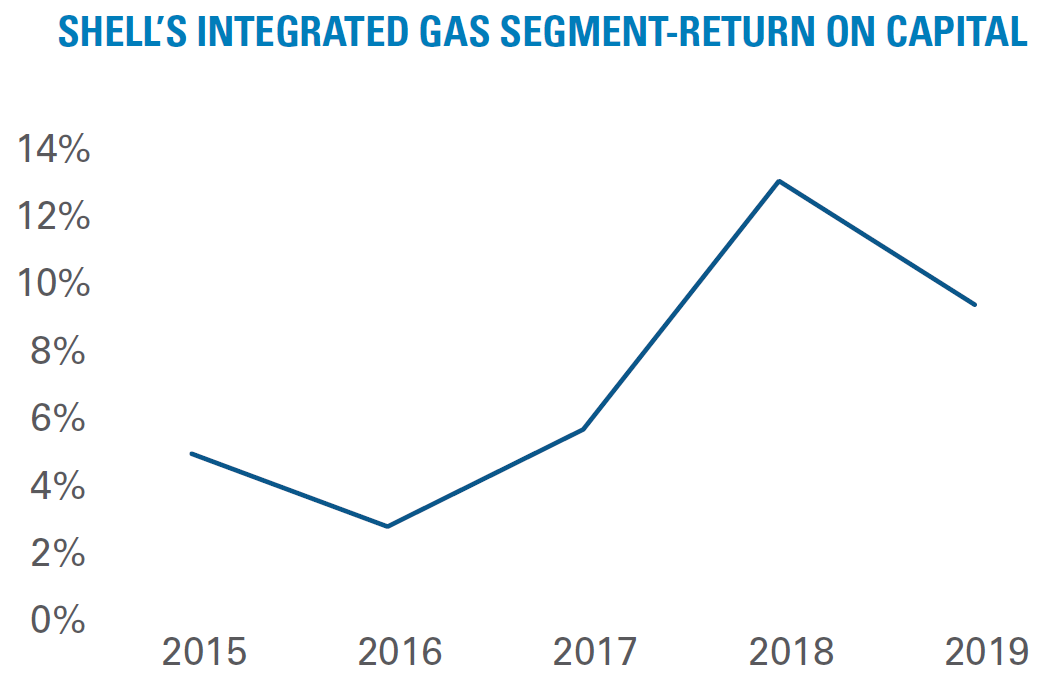

Investing in opportunities where the current energy players have a competitive advantage could add value. Royal Dutch Shell is building an effective business geared towards energy transition in its Integrated Gas business. Natural gas is an important transition fuel aimed at converting coal-fired electricity generation to cleaner, gas-fired solutions. Shell is the largest player in the liquified natural gas (LNG) value chain, and its Integrated Gas business leverages the unique strengths of the broader franchise through its access to natural gas production, operation of complex production and supply chains, commodity trading expertise that creates a differentiated well-to-customer value chain for a broad global client base. Shell’s investments in LNG, coupled with its longer-term ambition to be net-neutral by 2050, map out a path for the transition that is reasonable and economically sound. The figure below illustrates this point by showing the segment’s solid return on capital.

Generating Solid Returns and Growing Its LNG Business

Source: Company reports and Pzena estimates

Source: Company reports and Pzena estimates

ENEOS – GOOD INTENTIONS GONE AWRY

Sometimes the pursuit of green credentials come at the expense of capital discipline and long-term franchise sustainability. ENEOS, an energy and mining conglomerate in Japan, recently unveiled its medium-term business plan that proposed spending 85% of its ¥980 billion of discretionary free cash flow on new strategic investments—including ¥200 bn on environmentally conscious businesses and services. We were concerned both by the size of the investment and by management’s poor track record of investing in projects that generated weak returns on investment and in which they had little expertise.

Even a well-intentioned ESG strategy should not become disconnected from business strategy; in ENEOS’s case, too many of the proposed investments sat outside its operational core competencies. We believe that when a corporation deviates too far from the pursuit of long-term and sustainable shareholder returns, the results are usually negative, not just for shareholders but for all stakeholders. That is not to say we are opposed to all investments that capitalize on the needs of the energy transition. Instead, we engaged with management, expressing our preference for targeted high-return investment in green technology that leverages existing operating expertise.

Our engagement with ENEOS is ongoing and focuses on improving capital allocation and corporate governance.

- Advanced biofuels: Advanced chemistry along with design and installation of scale facilities is synergistic to oil major and service company expertise.

- Deep sea mining: Potential for offshore-focused oil services companies to leverage existing operational expertise in a deep-water environment.

- Geothermal: Exploiting deep geothermal opportunities are a natural fit for oil and gas majors and oil service companies.

A variety of energy companies are currently valued as if oil and gas demand is already declining rapidly and that the companies have no plans to adjust in the future. While the market is fixated on renewable energy as disruptive, we see opportunities for traditional energy players to monetize historical strengths and leverage them in the transition. For the integrated majors, areas such as carbon capture, geothermal, and hydrogen play to these strengths. For example, Exxon has accounted for 40% of all carbon captured to date and is a clear leader in this technology.

The better oil service companies have responded to revenue declines with investments in digital and remote technologies to protect and improve margins even at existing low activity levels. Underscoring the importance of selectivity, some of these companies will also benefit from growth in offshore wind, geothermal, deep-sea mining, or hydrogen. Some are already taking advantage of the opportunities presented in the energy transition by leveraging their engineering talent and industrial bases. Baker Hughes for instance has over a 90% market share in the supply of liquefaction units for LNG. Wood Group has an established business in engineering and construction services to renewable energy players.

3. Engage, don’t divest.

Shareholder engagement helps investors determine which transition plans are sound (and which aren’t). More importantly, it gives them a voice to ensure that companies allocate capital efficiently to projects that make sense. With the transition to a lower carbon economy underway, starving economically critical businesses of capital because they are more carbon intensive will only make the monumental task of the transition that much harder. Remember, the economic criticality of a business does not vanish because the industry needs to find a way to decarbonize. Walking away, i.e., divesting from these companies, achieves nothing and may drive them to other less-accountable sources of capital than the public markets.

Decarbonization in the auto industry was not about pulling capital out but rather finding better ways to put capital to work. The same should be true of energy investments. Through engagement, market participants can select which energy players are putting capital to work more effectively and allocate their investments accordingly.

As value investors, we capitalize on valuation dislocations while understanding the long-term sustainability of company-specific actions. Similarly, environmental issues provide a window for investment in the energy sector; when a company addresses transition risk in a way that is beneficial to long-term franchise value, management can improve returns and differentiate its corporate strategy. The controversy in energy today provides an opportunity to both underpay and invest in companies with sustainable strategies.

Source: International Energy Agency; BP p.l.c.

Source: International Energy Agency; BP p.l.c.  Source: International Energy Agency; BP p.l.c.

Source: International Energy Agency; BP p.l.c. Source: Company reports

Source: Company reports Source: Rystad

Source: Rystad Source: Company Reports and Citi Research

Source: Company Reports and Citi Research Source: Company reports and Pzena estimates

Source: Company reports and Pzena estimates