ESG FRAMEWORK

AUTOMOBILES

1. A Strong ESG Proposition Adds Value

As committed value investors, Pzena seeks to buy good businesses at low prices, focusing exclusively on companies that are underperforming their historically demonstrated long-term earnings power. Through bottom-up fundamental research we seek to determine whether such earnings shortfalls are temporary or permanent, and each investment decision weighs risk and return potential by considering all issues material to a company’s prospects.

Because ESG issues can have a material impact on a company’s earnings over time, they are evaluated like any other investment issue. Pzena’s integrated approach to ESG ensures that an understanding of material ESG risks and opportunities is incorporated into the research process. As many ESG issues will play out over a long timeframe, they require a future-oriented perspective, consistent with our long-term, buy-the-whole-business approach to investing.

2. What are ESG Industry Frameworks

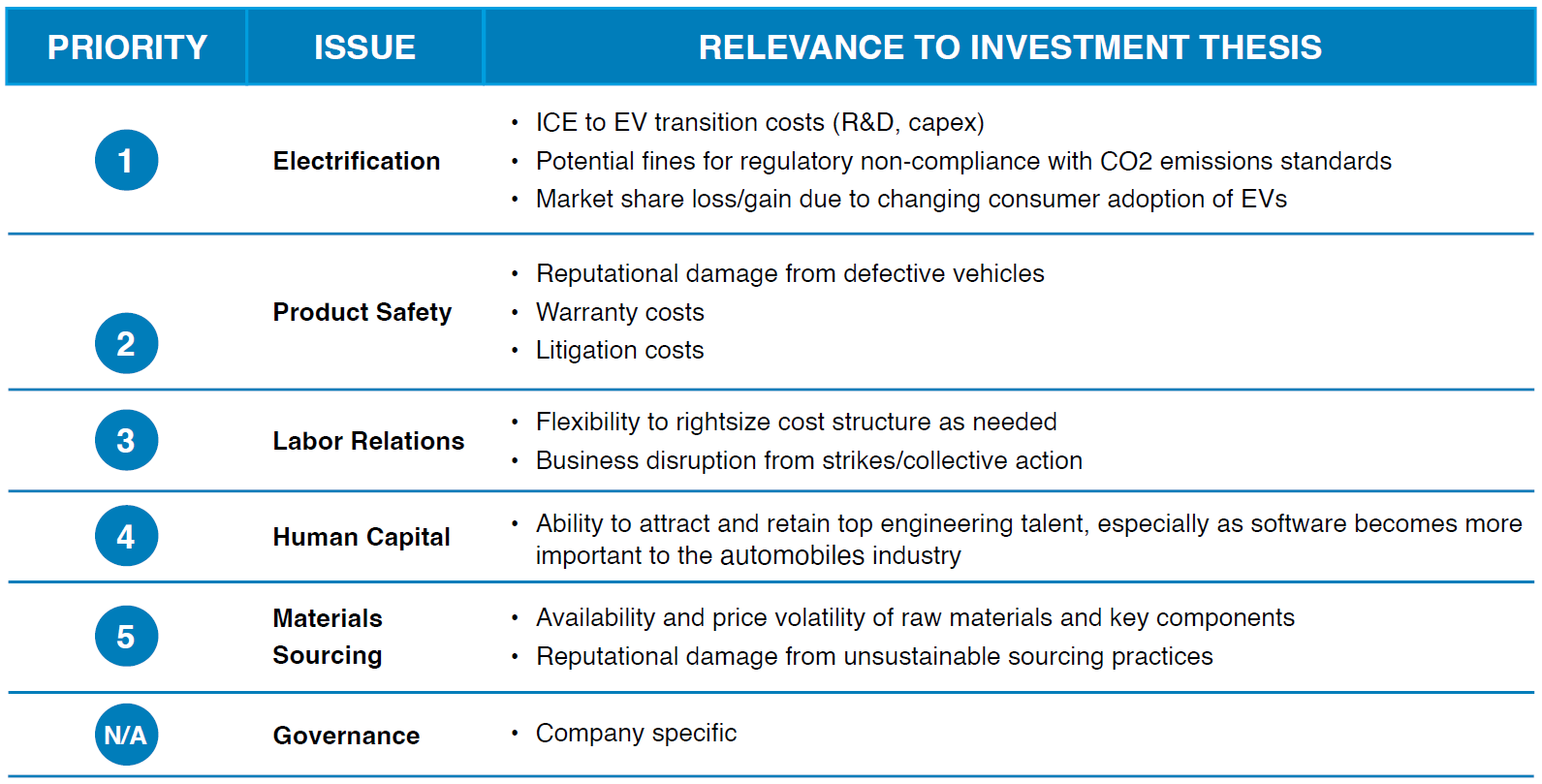

ESG frameworks provide an overview of the critical ESG issues relevant to an industry globally, which are part of our bottom-up, company-specific analysis. These frameworks distill material investment issues that can have an impact on a company’s financial performance; help identify and quantify additional potential risks and opportunities; and prioritize the most material ESG issues by industry.

Specifically, the frameworks:

- Ensure coverage of key material ESG issues within an industry;

- Provide a sound basis for quantifying and assessing these issues;

- Provide a way of prioritizing issues for each company-specific situation.

While these ESG frameworks are relevant to all companies in a specific industry, company-specific nuances and geographical considerations always determine any variation to, and prioritization of, our research into these areas. The issues highlighted in a framework do not reflect all potential ESG issues for a company but are a guide to what we think are the most common and material issues. Company-specific materiality will always be evaluated on a case-by-case basis by our investment team.

We developed these frameworks from a comprehensive set of inputs that we evaluated as part of our proprietary research process. In so doing we referred to a wide range of third-party ESG data sources, including SASB (the Sustainability Accounting Standards Board), MSCI, RepRisk, and company-reported information.

3. Automobiles Framework

An example of how we apply this framework to electrification — the most critical ESG issue facing the automobiles industry — is outlined below. The path toward electrification for any original equipment manufacturer (OEM) will depend on a wide range of interrelated factors, including technology evolution, changes to regulation, and consumer preferences. As such, while unlikely to capture all these factors here, we highlight how a couple of these factors can create risk or opportunities for incumbent OEM players.

Some OEMs view electrification as an opportunity to tap new markets and expand in existing ones. Others view it as a threat to their current business model. For example, EV-only OEMs see electrification as a big opportunity as they are clearly ahead of the curve and are aiming for greater market share, of which most today have little to none. Even Tesla, the leader in EVs, with 19% of the EV market (70% in the US), produced just 1.8% of total light vehicle sales in North America in 2021. For EV-only challengers, electrification is a chance to break into the automobiles industry and stake a claim in the growing share of EVs on the road.

Meanwhile incumbent OEMs must shift their strategy away from internal combustion engine (ICE) vehicles toward EVs. Incumbent OEMs have had a surprisingly wide range of strategies to transition from ICE to EVs. For example, some have been selling EVs for years while others won’t introduce an EV until later this decade.

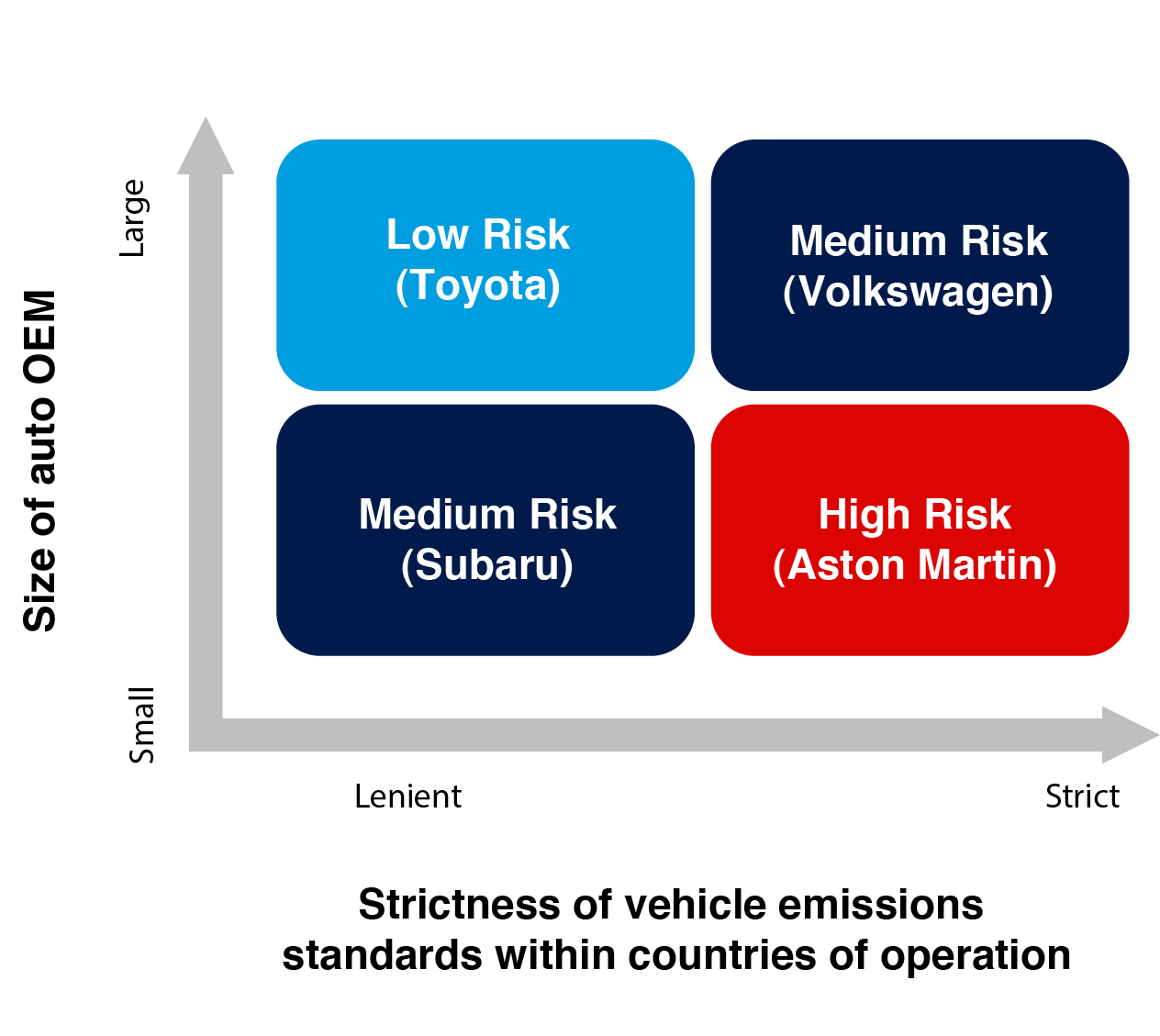

What strategy an incumbent OEM chooses, and the risk involved, are primarily driven by two factors: (1) size of the OEM and (2) strictness of vehicle emission standards within its core markets (see Figure 1). EV development is inherently expensive —costing tens of billions of dollars in R&D and capex — and, hence, size matters. Larger OEMs have the resources and cash flow to invest in electrification and are typically at the forefront of the transition away from ICE vehicles. Smaller OEMs, on the other hand, lack the resources necessary to overhaul their business. As such, the risk is greater for OEMs that lack scale to manufacture EVs that consumers want.

The second factor impacting an OEM’s EV strategy is strictness of vehicle emission standards in its core markets. The risk to valuation is greatest for OEMs that sell ICE vehicles in countries whose governments are pushing a greener, all-electric future. European countries, for example, have been pushing aggressively toward zero emission from road transport, forcing OEMs to make the necessary investments to electrify their fleets or face stiff penalties. The United States and China are following Europe’s lead, while emerging economies are generally further behind. The difficulty with assessing this risk is that administrations and policies are constantly changing, coupled with the fact that companies need to plan for these investments over several years.

4. Application of the Framework: Volkswagen

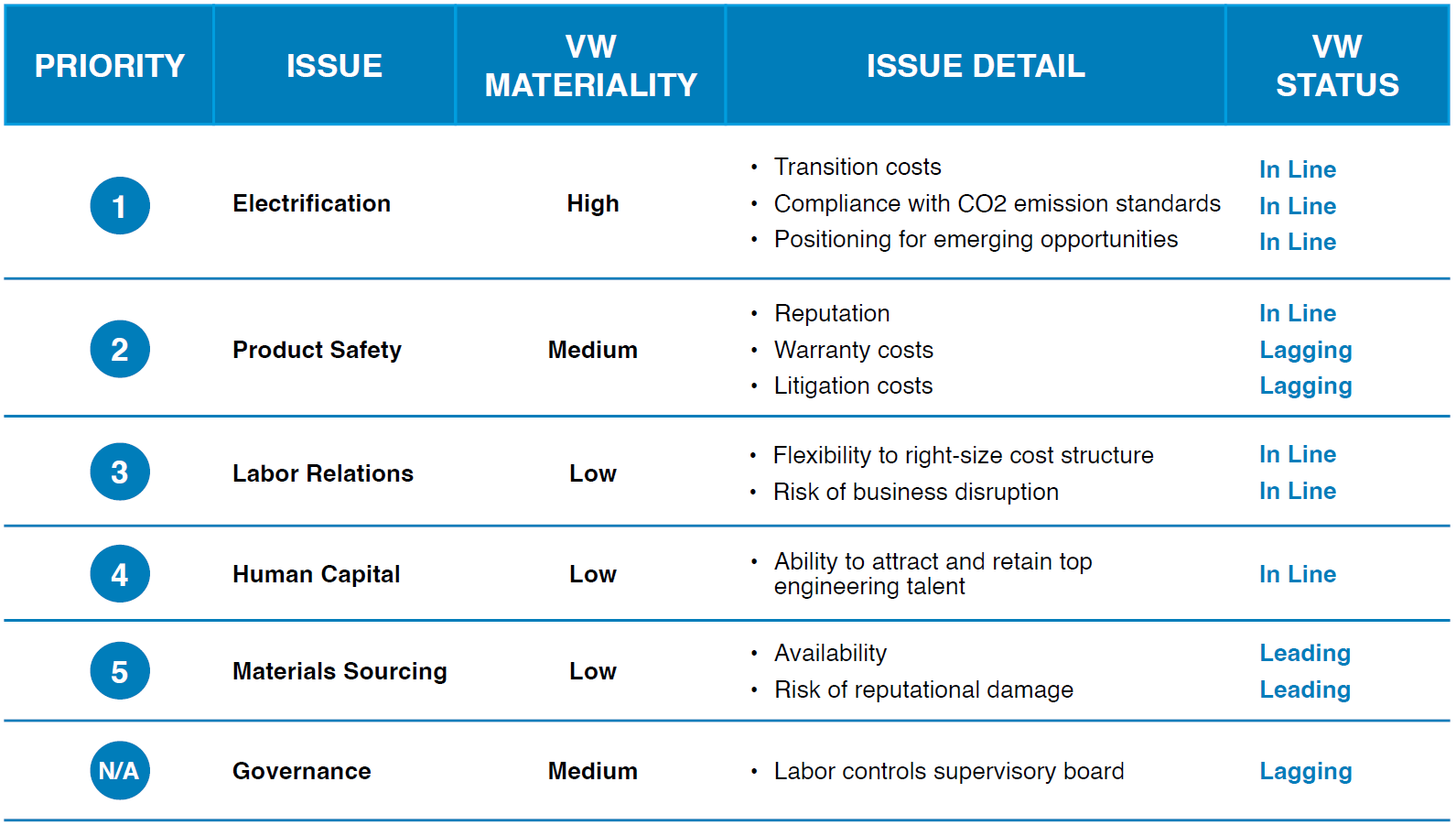

Pzena is bottom-up oriented and, therefore, we look at each company on a case-by-case basis. Below we use Volkswagen to illustrate how our auto framework can be applied to a specific company.

Volkswagen is the second-largest auto manufacturer by sales with brands including Volkswagen, Porsche, Audi, ŠKODA, SEAT, Bentley, Scania, MAN, Lamborghini, Ducati, and Bugatti. Headquartered in Germany, the company’s main sales markets are Western Europe and China, with additional volumes spread widely across several other key regions.

How Volkswagen rates on the broad framework issues:

Volkswagen is facing ESG-related challenges to its business model primarily from electrification and product safety, both of which are impacting earnings and the range of outcomes for the business. Volkswagen’s management has embarked on a forward-thinking strategy to overcome these challenges, turning them into growth opportunities.

1. Electrification Risk

The greatest risk and opportunity facing Volkswagen is the shift to EVs. While costs to transition the company are massive — Volkswagen is forecasting $86B on future technologies through 2025 — the real risk to Volkswagen is not moving fast enough in its electrification transition. The battle for EV market share has begun, and it is being waged by incumbent OEMs as well as new entrants, most notably Tesla. The increased competition is a result of lower barriers to entry in electrification technology.

Despite increased competition, it is our view that the largest incumbent OEMs like Volkswagen are well positioned to out-compete most newer entrants in the automobile industry from a capital perspective. The EV race is a marathon, and any EV business will require years of negative free cash flow to reach profitability. Having an existing ICE business that generates positive cash flow will allow incumbent OEMs to bear the costs of electrification. EV-only manufacturers must rely on financing from capital markets to get to profitability, and any setback along the way could shut them down.

Europe, Volkswagen’s largest market, has been aggressive in setting legislation to accelerate the EV revolution. Tightening of CO2 emissions for passenger cars means the pace of electrification needs to be stepped up by automakers. Europe’s CO2 emissions target was 95 g/km for 95% of each manufacturers’ new passenger cars registered in 2020, increasing to 100% from 2021 onwards. Volkswagen faced a fine of more than 100 million euros for missing the 2020 EU target (manufacturers pay €95 for each g/km exceeding the target per vehicle) but is likely to reach 2021’s target. Looking ahead, it should be relatively easy for Volkswagen to comply until 2025, at which point yet-to-be-announced Euro 7 (Europe’s auto emissions standards) will take effect. Details of Euro 7 will be influenced by the European Commission’s broader “Fit for 55” legislation package, which seeks to cut CO2 emissions targets by a further 55% by 2030 followed by 100% cut by 2035 — meaning it would be practically impossible to sell internal-combustion engine vehicles in Europe after that.

Volkswagen’s electrification push in Europe, to keep up with stricter emissions standards, has created an opportunity to take share in the United States, where emissions standards are less stringent and incumbent OEMs like Ford and GM have been less aggressive in their electrification plans, at least until recently. As a result, Volkswagen has a 9% market share in EVs in the United States compared to its ICE market share of 4%.

2. Product Safety Risk

Volkswagen took a massive hit in 2015 when its Dieselgate emissions scandal came to light. The company has already paid out more than €33 billion in penalties, financial settlements, and warranty costs related to the scandal, with more on the way. Reputational damage, though difficult to quantify, likely cost the company billions of euros more in lost sales as many consumers lost trust in the Volkswagen brand.

The good news is that Volkswagen used Dieselgate to change the culture within the company, reinventing itself as a leader in electrification. Today Volkswagen is seen as the incumbent OEM best positioned to challenge Tesla in electric vehicles — a far cry from where it was six years ago when the name Volkswagen was synonymous with cheater and polluter. Moreover, we believe Volkswagen understands that product safety is a win-win. Safe vehicles save lives and build consumer trust while also lowering warranty and litigation costs. Meanwhile vehicle defects and safety recalls can lead to reputational damage and lower margins.

3. Other ESG Risks

Volkswagen faces other material ESG risks including those associated with labor relations, human capital, materials sourcing, and governance. These risks are difficult to quantify; nevertheless, their importance is real, and they can have a direct impact on financial performance. For example, Volkswagen is often criticized for its governance. The issue is that labor effectively has majority control of the company’s supervisory board. As required by German law, Volkswagen’s 20-person board is split evenly between labor representatives and shareholder representatives; however, the state of Lower Saxony, where many Volkswagen employees work, appoints two shareholder representatives (through its 20% ownership of the voting shares) and tends to side with the 10 worker representatives. With 12 of the 20 votes, the worker representatives and the state of Lower Saxony together can block efforts to cut jobs and make the company more efficient, creating a long-running conflict between management and labor leaders at Volkswagen.

4. Engagement with Volkswagen

We have had several discussions with management on electrification and how the company’s strategy is aligned to mitigate the risks and benefit from this trend. We have met with Volkswagen’s CEO and CFO at least once per year, with additional engagements with Investor Relations and the company’s ESG team when we are considering how to vote proxies. We believe that the management team is very competent and attuned to facing ESG-related challenges, and we will continue to engage with them frequently.

Opportunity List

Our Opportunity List provides us with a structure to utilize fundamental research for assessing the likelihood of issue improvements.

ESG FRAMEWORK

OIL SERIVCES

1. A Strong ESG Proposition Adds Value

As committed value investors, Pzena seeks to buy good businesses at low prices, focusing exclusively on companies that are underperforming their historically demonstrated long-term earnings power. Through bottom-up fundamental research we seek to determine whether such earnings shortfalls are temporary or permanent, and each investment decision weighs risk and return potential by considering all issues material to a company’s prospects.

Because ESG issues can have a material impact on a company’s earnings over time, they are evaluated like any other investment issue. Pzena’s integrated approach to ESG ensures that an understanding of material ESG risks and opportunities is incorporated into the research process. As many ESG issues will play out over a long timeframe, they require a future-oriented perspective, consistent with our long-term, buy-the-whole-business approach to investing.

2. What are ESG Industry Frameworks

ESG frameworks provide an overview of the critical ESG issues relevant to an industry globally, which are part of our bottom-up, company-specific analysis. These frameworks distill material investment issues that can have an impact on a company’s financial performance; help identify and quantify additional potential risks and opportunities; and prioritize the most material ESG issues by industry.

Specifically, the frameworks:

- Ensure coverage of key material ESG issues within an industry;

- Provide a sound basis for quantifying and assessing these issues;

- Provide a way of prioritizing issues for each company-specific situation.

While these ESG frameworks are relevant to all companies in a specific industry, company-specific nuances and geographical considerations always determine any variation to, and prioritization of, our research into these areas. The issues highlighted in a framework do not reflect all potential ESG issues for a company but are a guide to what we think are the most common and material issues. Company-specific materiality will always be evaluated on a case-by-case basis by our investment team.

We developed these frameworks from a comprehensive set of inputs that we evaluated as part of our proprietary research process. In so doing we referred to a wide range of third-party ESG data sources, including SASB (the Sustainability Accounting Standards Board), MSCI, RepRisk, and company-reported information.

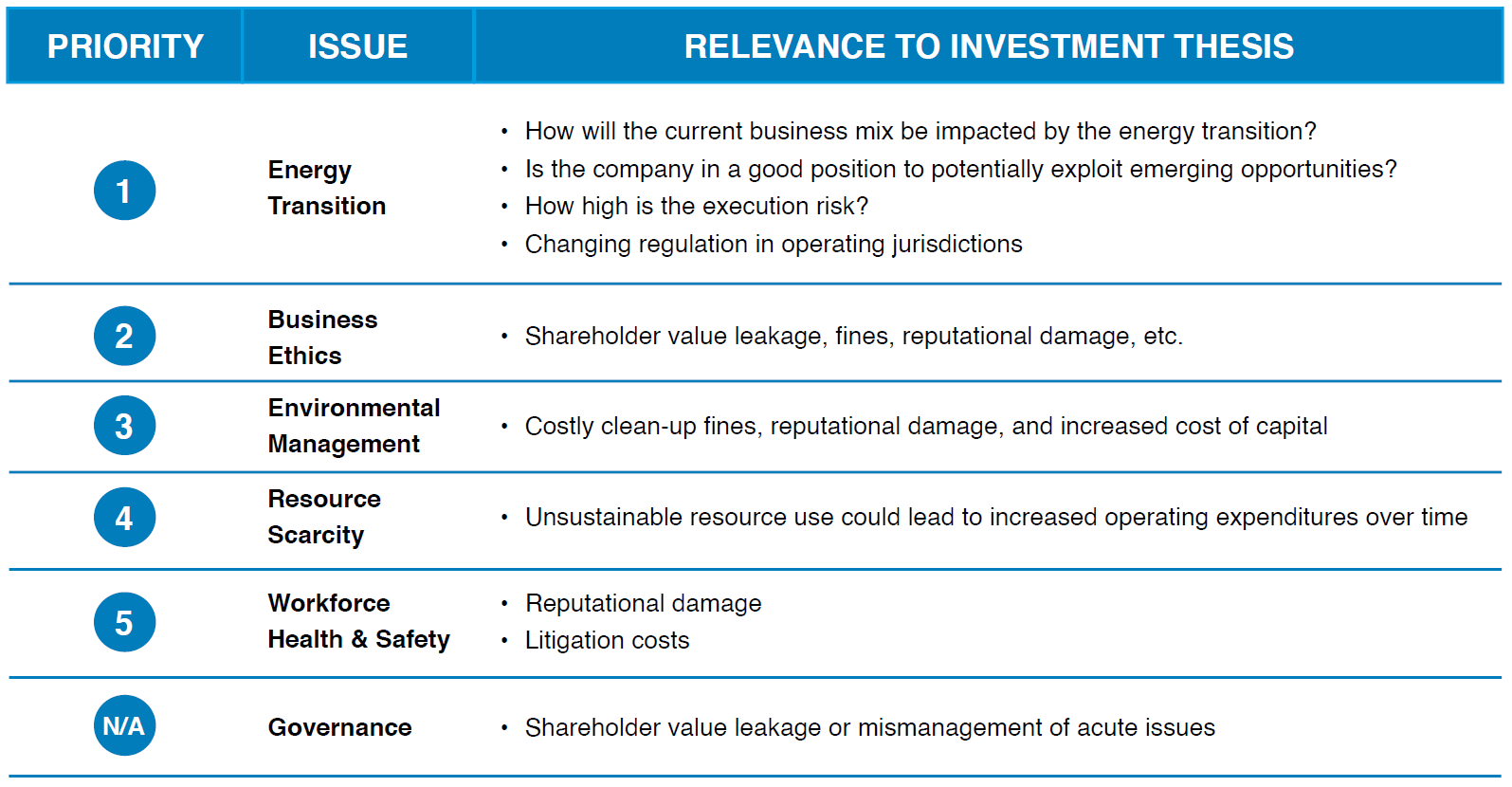

3. Oil Services Framework

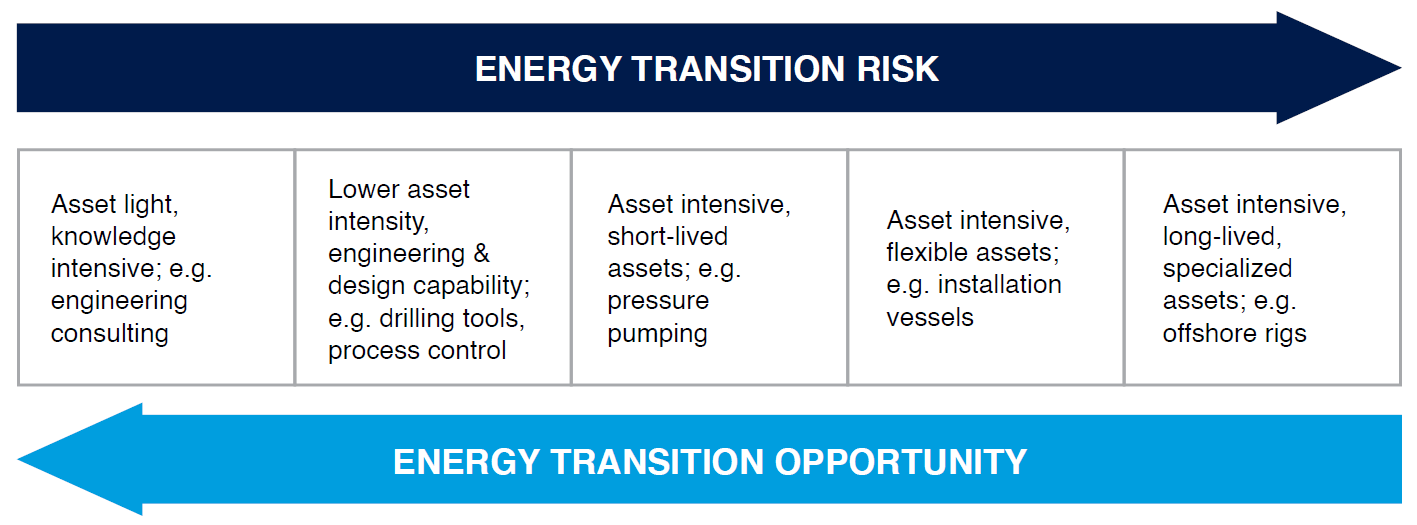

We believe effectively handling the energy transition is of primary importance for the oil services industry. The energy transition is both a threat and an opportunity for these companies. The threat of the energy transition is in the potential reduction of the future addressable market for the oil services industry and the potential for lower returns on capital in the future. The opportunity is for new businesses that will enable the energy transition, which need material engineering expertise that the oil services industry could be uniquely suited to provide.

The energy sector encompasses a wide diversity of sub-industries and, within them, many different businesses with varying asset intensities. The companies within the oil services industry most at risk from energy transition are asset intensive companies where the assets are very specialized. Offshore drillers fit this description. Offshore drilling rigs are among the most expensive assets in the industry and have an asset life of 25–30 years. The rigs require capital spending on periodic maintenance, and they have high operating costs. So, if the revenue for the industry is weak and there is excess capacity, it takes a long time for capacity to be taken out. Drilling rigs are very specialized equipment, thus offering very limited potential to be repurposed to serve another market. This in turn causes the industry to price very aggressively in lean times, pressuring profitability and return. Installation vessel companies are in a slightly better situation. Offshore installation vessels are also long-lived, expensive equipment that have high carrying and operating costs. However, the vessels are more flexible and can potentially be repurposed to install offshore wind farms, leading to lower risk/higher opportunity from energy transition.

At the other end of the spectrum are knowledge-based companies with human capital as their primary asset, such as the Engineering & Construction players. A downward pressure on revenue impacts their profitability, but these companies can respond faster by restructuring the workforce. Moreover, as the primary asset in this industry is engineering talent, and the opportunities in the energy transition are nascent industries with material engineering needs, the E&C companies should be able to build good, differentiated offerings.

While the above discussion provides a broad framework for thinking about the energy transition risks and opportunities for the oil services sector, the assessment of a specific company requires a bottom up process that considers its unique business mix and competitive advantages. For example, Baker Hughes, discussed below, has an asset intensive business in Turbomachinery; the division’s material exposure to liquified natural gas (LNG) makes it uniquely suited to compete in some of the emerging energy transition opportunities.

4. Application of the Framework: Baker Hughes

Baker Hughes is a diversified oil services company held in multiple Pzena portfolios. Baker Hughes is the second-largest oil services company; It has a broadly diversified line-up of products and services across all the major geographical markets, and, while it, and the broader industry, has material ESG considerations, Baker Hughes is one of the better-positioned oil services players to effect the energy transition, and is managing its ESG exposure well. The company has also reduced its cost structure in this downturn substantially.

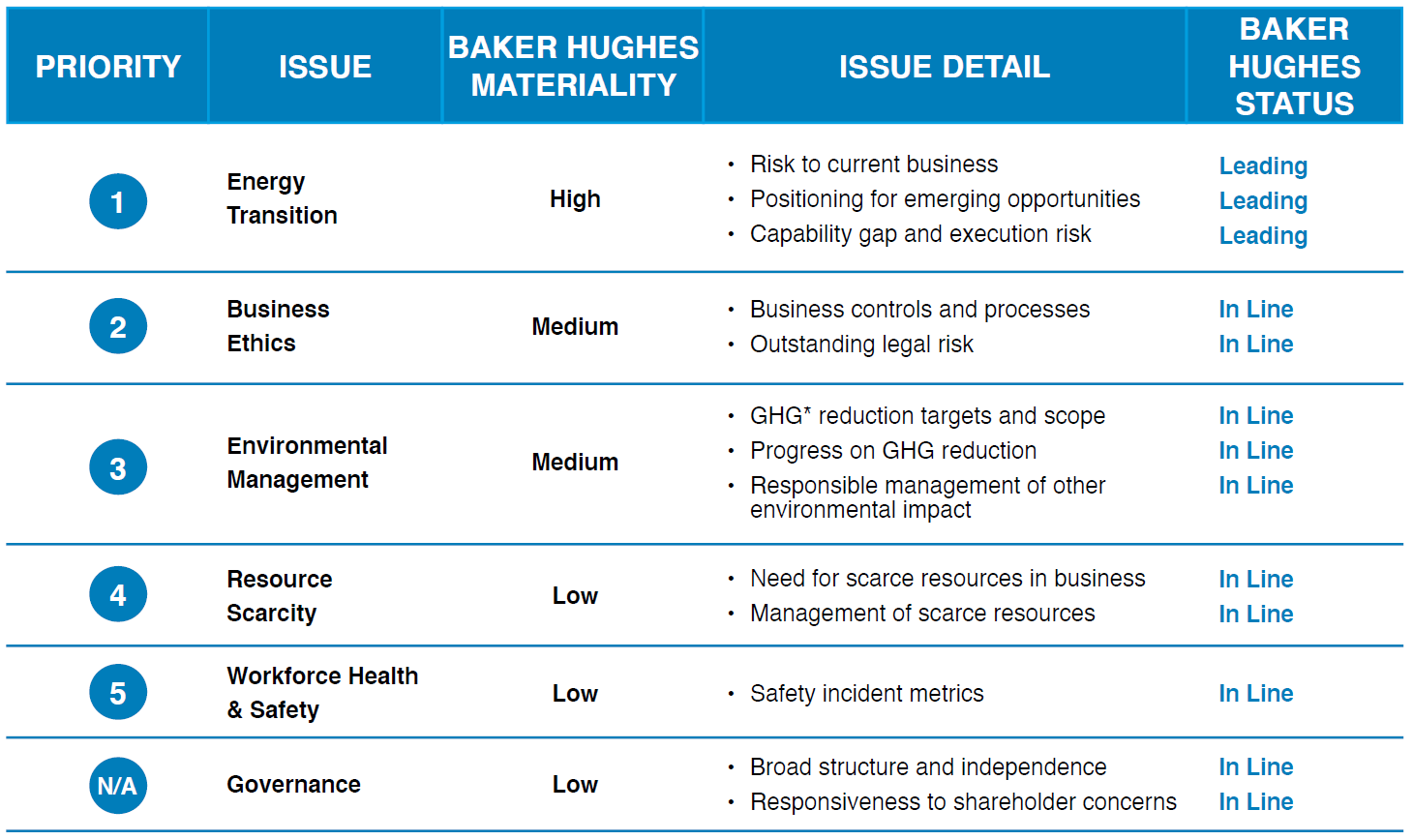

How Baker Hughes rates on the broad framework issues

*greenhouse gas

*greenhouse gas

Managing the Energy Transition

Baker Hughes is well positioned to manage the demands of the energy transition partly because the Turbomachinery and Process Solutions (TPS) segment has a dominant position in the LNG market, having over 90% market share of the installed base. LNG demand is projected to grow faster than overall oil & gas demand as it takes an increasing share in electricity generation from coal, particularly in emerging markets like China and India. TPS is a very significant segment for Baker Hughes’s future earnings:

- TPS generates about 30% of Baker Hughes’s revenues and about 35% of TPS’ revenues are from the LNG market;

- The LNG installed base is around 430 MTPA (Million Tonnes per Annum), and it’s expected that another 100–150 MTPA of capacity needs to be added in the next few years;

- Baker Hughes will generate service revenue from its installed base, and equipment revenue from new installations, repairs, and upgrades;

- The company sells upgrades to convert its gas turbines to run on hydrogen.

The TPS segment is also well set to take advantage of any opportunity in the emerging Hydrogen and Carbon Capture markets. Both these markets need extensive gas handling equipment similar to the LNG market that Baker Hughes dominates. As Hydrogen and Carbon Capture efforts develop and mature, Baker Hughes is among the best positioned to derive meaningful revenue from the supply of equipment and services. Such revenue could provide material upside to our current projections.

Current revenue depends on oil & gas industry spending, and, consequently, it will be impacted in the long term by falling oil & gas demand resulting from the energy transition. However, even the most aggressive energy transition scenarios forecast oil & gas demand peaking sometime in the next decade, and then declining by low single digits per year thereafter. Given the natural decline rate of oil & gas production of 5–8% per annum, it is estimated that the oil & gas industry might need to spend upwards of $9 trillion in cumulative real dollars to 2050 in order to meet expected oil & gas demand. This implies that there will be substantial revenues for the oil services industry from oil & gas extraction for the foreseeable future and, given the dynamics of an industry in transition, we expect the stronger players to gain share. We expect the company to generate prior levels of profitability from lower revenues due to substantial cost restructuring.

Business Ethics

While there are two outstanding investigations against Baker Hughes, we do not view the financial exposure as material. The US Department of Justice and Securities and Exchange Commission (SEC) are investigating Baker Hughes on its dealings with Unaoil. Unaoil acted as a middleman in the middle east and central Asia for most of the major oil & gas players and is charged with bribing officials in these countries to win contracts on the behalf of its principals. Baker Hughes is under investigation for its dealings with Unaoil in Iraq, though evidence of wrongdoing has yet to been found. Baker Hughes has recently strengthened its processes to guard against such issues. It undertook a comprehensive review of its Code of Conduct policies in 2019, and provides extensive training to its workforce on key elements, including its anti-bribery and corruption policy. The company’s exposure to this issue is not likely to be material and we believe the company’s provisions adequately reflect the potential risk as of now.

The SEC has also recently initiated an investigation of Baker Hughes regarding sale of products and services to projects that might have been impacted by US sanctions. In response, the company is conducting its own independent review of its controls and processes for complying with US sanctions.

The oil & gas industry operates in some challenging geographies and Baker Hughes’s business practices compare well with industry peers.

Environmental Management

Baker Hughes has adequate focus on responsible usage of environmental resources. For example, Baker Hughes has:

- A target to reduce its Scope 1 & 2 emissions by 50% by 2030. The company is making good progress on this commitment and reduced its emissions by 31% in 2019 compared to its 2012 baseline;

- Adopted better water management as one of its goals in 2019 and is in the process of establishing appropriate metrics and targets.

Other ESG Issues

We do not believe that Baker Hughes has material risks in the other components of our oil services framework. The company is not overly dependent upon a scarce resource in its business operations. Baker Hughes has adequate reporting on its workplace safety, and its metrics are in line with the industry. General Electric (GE) is the largest shareholder in the company but is committed to reducing its stake over time. GE’s stake and its intention to liquidate its position does create an overhang for the company’s stock, but GE has proved to be a rational seller to this point.

Engagement with Baker Hughes

Pzena is one of the largest shareholders of Baker Hughes and we have held a position in the company for over three years. During this time we have had regular engagement with the management team, including meetings and calls with the CEO and/or CFO. In addition, we have engaged with divisional heads, the corporate secretary, and the chief sustainability officer. The focus of these discussions was primarily Baker Hughes’s strategy and its response to near- and medium-term challenges. We had discussions on the company’s response to the energy transition and have communicated our perspectives on the company’s plans and strategies to management. We continue to engage with the company effectively on its material ESG exposures.

Opportunity List

Our Opportunity List provides us with a structure to utilize fundamental research for assessing the likelihood of issue improvements.

ESG FRAMEWORK

UTILITIES

1. A Strong ESG Proposition Adds Value

As committed value investors, Pzena seeks to buy good businesses at low prices, focusing exclusively on companies that are underperforming their historically demonstrated long-term earnings power. Through bottom-up fundamental research we seek to determine whether such earnings shortfalls are temporary or permanent, and each investment decision weighs risk and return potential by considering all issues material to a company’s prospects.

Because ESG issues can have a material impact on a company’s earnings over time, they are evaluated like any other investment issue. Pzena’s integrated approach to ESG ensures that an understanding of material ESG risks and opportunities is incorporated into the research process. As many ESG issues will play out over a long timeframe, they require a future-oriented perspective, consistent with our long-term, buy-the-whole-business approach to investing.

2. What are ESG Industry Frameworks

ESG frameworks provide an overview of the critical ESG issues relevant to an industry globally, which are part of our bottom-up, company-specific analysis. These frameworks distill material investment issues that can have an impact on a company’s financial performance; help identify and quantify additional potential risks and opportunities; and prioritize the most material ESG issues by industry.

Specifically, the frameworks:

- Ensure coverage of key material ESG issues within an industry;

- Provide a sound basis for quantifying and assessing these issues;

- Provide a way of prioritizing issues for each company-specific situation.

While these ESG frameworks are relevant to all companies in a specific industry, company-specific nuances and geographical considerations always determine any variation to, and prioritization of, our research into these areas. The issues highlighted in a framework do not reflect all potential ESG issues for a company but are a guide to what we think are the most common and material issues. Company-specific materiality will always be evaluated on a case-by-case basis by our investment team.

We developed these frameworks from a comprehensive set of inputs that we evaluated as part of our proprietary research process. In so doing we referred to a wide range of third-party ESG data sources, including SASB (the Sustainability Accounting Standards Board), MSCI, RepRisk, and company-reported information.

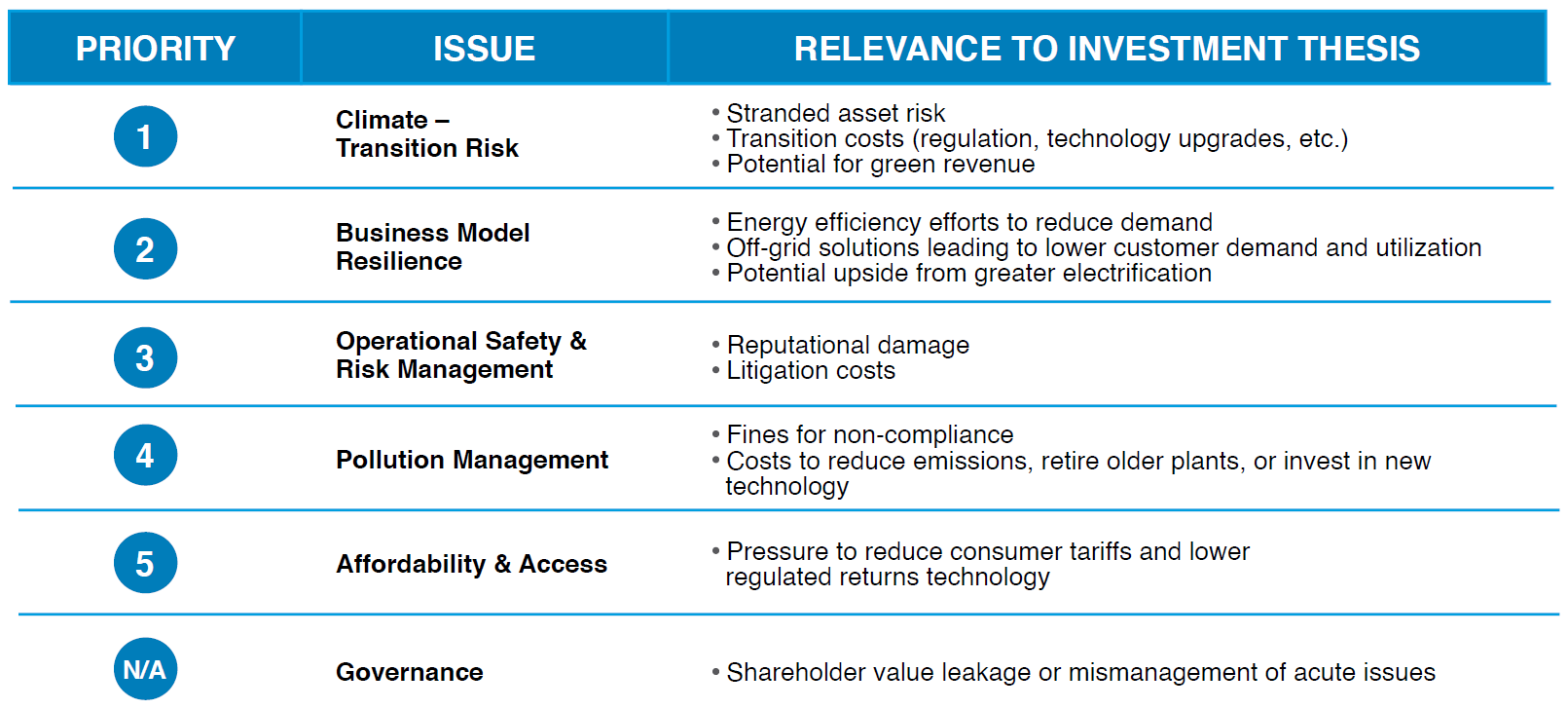

3. Utilities Framework

The framework maps the most critical ESG issues facing the utilities industry globally, and is used to assess a utility company’s effective financial exposure to these issues.

While this framework is generally applicable to the industry globally, company-specific situations and geography are critical in its application. An example of how we apply this framework to stranded asset risk – the biggest risk for utilities– is outlined below.

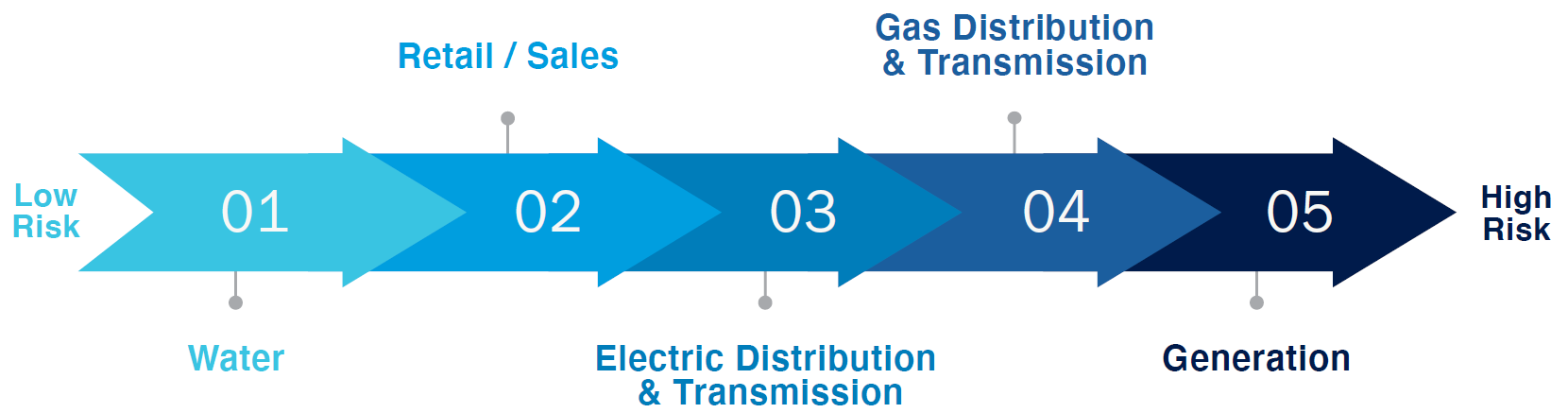

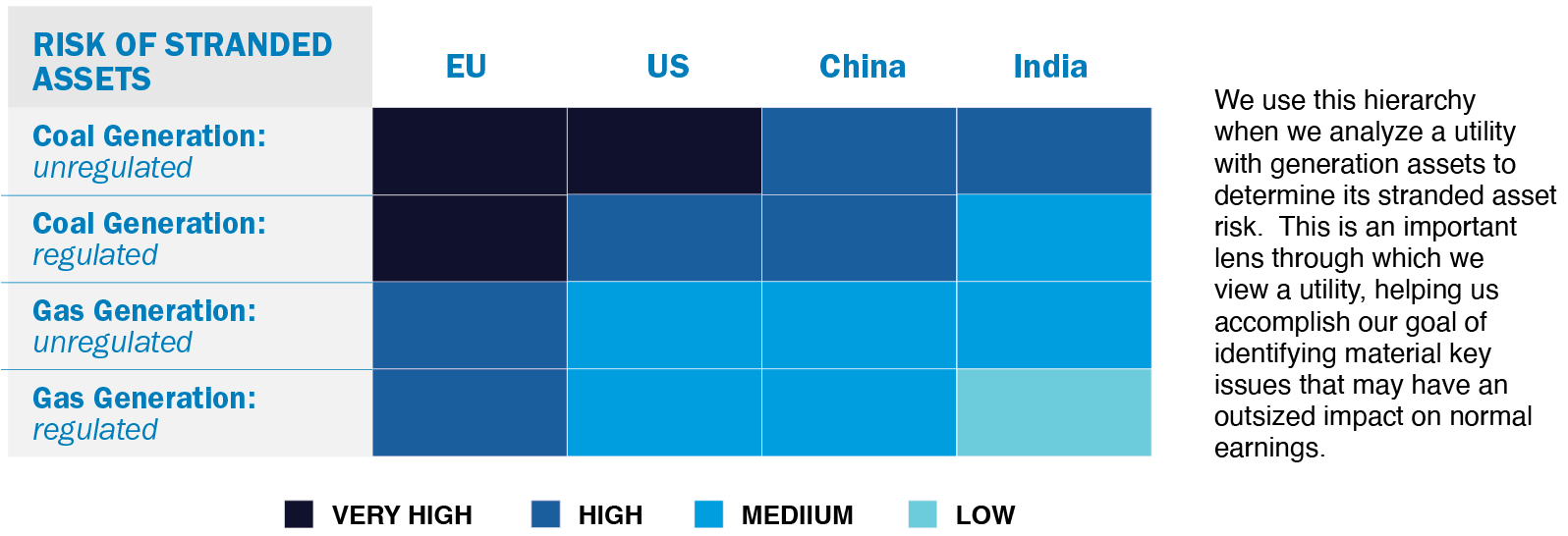

The risk of stranded assets for any company will depend on a myriad of factors, including asset quality, regulatory regime and geographical market conditions. We applied this lens to the entire utilities sector, and identified the industry components (gas, electric, etc.) with the highest risk of stranded assets.

Utilities Value Chain Stranded Asset Risk from Lowest to Highest Risk

Zeroing in on what matters.

The first determining factor is the part of the value chain a utility operates in. In general, industries such as retail electricity sales or water have limited material risk, aside from the need to decarbonize their own operations. Also, electric distribution and transmission, which are almost always regulated, may benefit from the climate transition due to the need for more investments in an electrified world. Gas distribution faces some long-term risks as heating may move from gas to electricity, but there are several distinct factors that mitigate the risk: specifically, the regulated nature of the assets with precedent examples of compensation for early retirements, and the possibility that the existing infrastructure could be repurposed to run on hydrogen. The segment that faces the highest stranded asset risk is generation. As the world moves toward decarbonization, fossil fuels-based (coal and natural gas) generation will have the highest risk of being stranded and replaced by other generation assets.

The other critical factor to consider is the country / geography within which a utility operates. Location dictates dependence on each source of fuel, and determines the growth rate of a company’s power demand. All things being equal, higher power demand growth means that a country has less opportunity to reduce its legacy power generation capacity – no matter how polluting it may be – for lack of a straightforward alternative to keep the lights on, and support economic growth. Additionally, if a high proportion of a country’s generation is coming from burning fossil fuels like coal, it takes significant investment and lead time to replace these assets with greener generation, postponing the stranded asset risk further into the future.

The third, and sometimes the most critical, factor to consider is the overall policy environment and decarbonization goals in the country the utility operates. Policy decisions can dramatically shift the industry landscape at short notice and can create stranded assets overnight. Broadly speaking, developed countries have aggressive carbon reduction targets in place, whereas emerging economies may allow overall emissions to grow before beginning to decarbonize in 2030 or later. Needless to say, immediate decarbonization presents a higher level of near-term risk to existing fossil fuel assets.

A fourth aspect we must consider is whether generation assets are regulated or free-market, and whether there is any past precedent for owners of stranded assets receiving compensation. A regulated generation system has risks, such as potential lower future returns, but the risk is lower than an unregulated free-market system where an asset could become stranded very quickly given policy changes.

These issues are generally some of the most critical in assessing the risk of stranded assets for company or sub-sector of the industry. Of course, these considerations are not exhaustive. For example, higher scale power plants are less polluting, so have lower stranded risk versus a smaller size plant in the same location.

We use these considerations to develop a risk hierarchy for publicly traded utilities across four major geographies: the EU, the US, China, and India. The EU has a slow-growth market, has strict decarbonization goals, and the generation fleet is largely unregulated. Fossil fuels make up a swiftly decreasing part of the asset base, owing to a widespread renewables buildout, and overall power demand is growing slowly – less than GDP growth. Taken overall, the EU has a high level of stranded asset risk, and coal assets in particular should essentially be seen as runoff assets with near term expiration dates.

The US also has robust decarbonization goals, though, compared to the EU, they are less detailed and lack tangible policies such as a carbon tax. Power demand growth is higher than in Europe, but also lower than GDP growth. The main nuance to consider in the US is that utilities are regulated on a state-by-state basis1; in some states, generation is free-market, while in other states it is entirely regulated. Consequently we must make a distinction between regulated and non-regulated generation, recognizing a higher degree of stranded asset risk embedded in the latter.

China and India are similar in that they have extensive fossil fuel asset bases (especially coal), and, as their economies are growing rapidly, both are seeing robust long-term power growth. Additionally, the decarbonization goals in both countries allow for total emissions to rise through 2030 (though emissions intensity is expected to decrease), before beginning to decline toward net zero in 2050, or later. The main difference between the two countries is that thermal generation in India is fully regulated, with generators allowed to earn a return on assets regardless of demand or actual production, while China’s generation is mostly a free-market system, where earnings are based on volumes sold. Thus, the stranded asset risk is higher in China.

To put it all together, we created a hierarchy of stranded asset risk for the generation industry across these geographies:

4. Application of the Framework: Enel

ESG issues can directly impact a company’s earnings drivers (revenue, OPEX, CAPEX, etc.), and can also subjectively impact its risk profile by affecting the range of outcomes (positively or negatively). Below we highlight Enel (a diversified Italian utility) to illustrate how we incorporate the utilities framework into our research.

In addition to Italy, Enel has significant international operations in Spain, Latin America, and North America. The company operates across the utility value chain and has significant operations in traditional generation, renewables generation, infrastructure & networks, and end-use customer retail.

As Enel is managing its complex exposure to ESG effectively, it’s a good example to show how ESG can connect to company value drivers.

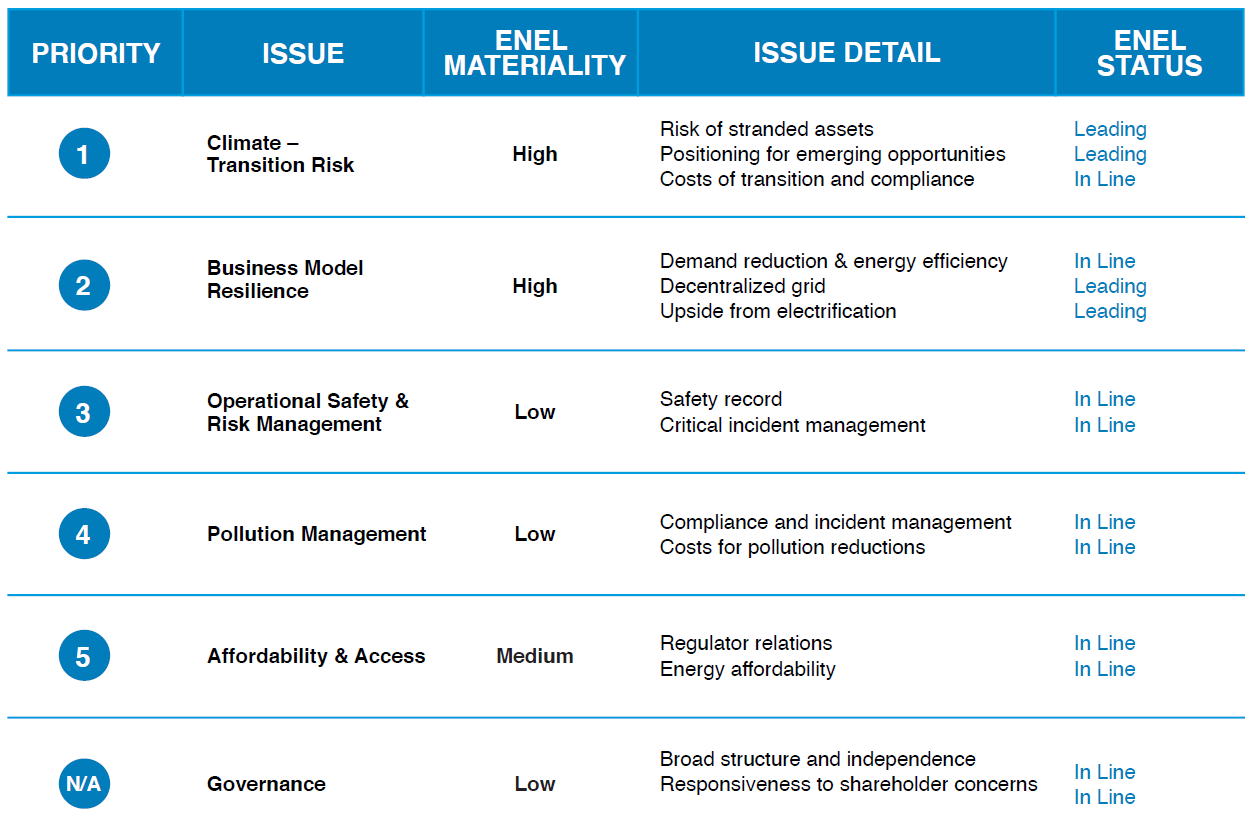

How Enel rates on the broad framework issues

Enel has faced ESG-related challenges to its business model primarily in the form of climate transition risk and business model resilience risk in the face of changing demand trends within the utility sector. However, Enel’s management has embarked on a forward-thinking strategy that should ultimately position the company as a beneficiary of the move toward decarbonization, and we have engaged numerous times with senior management to understand their strategy and approach to the relevant risks.

Climate Transition Risk

As a utility with a large traditional generation fleet, Enel inherently possesses some stranded asset risk, especially with coal-fired power. Management, however, has been forward-thinking in managing its asset base and has effectively turned a risk into an opportunity through three main initiatives:

- The company has reduced its coal capacity from 16 GW in 2017 to 9 GW in 2020 and has accelerated its eventual exit to 2027, minimizing its interim investment in those assets;

- Enel has invested heavily in renewables and we believe it has become the largest private renewable operator in the world, with 49 GW of capacity as of 2020. It has ample runway for further growth with about 200 GW of additional capacity in its project pipeline, giving it the optionality to pursue the projects with the highest returns, and its large existing asset base and project management experience give it advantages of scale compared to other renewable operators;

- The company will maintain its position in select natural gas generation plants during the energy transition where plants are still profitable and offer sufficient returns. But overall thermal production is expected to decline to 16% of the company’s total by 2030 vs. 34% in 2020.

Additionally, Enel is targeting emissions cuts consistent with a 1.5 degree warming scenario, including an 80% cut in Scope 1 emissions by 2030 and a 16% cut in Scope 3 emissions, and a commitment to net zero by 2050. All of these actions show that Enel’s management team is well aware of the climate transition risk and has done a good job positioning the business to not only manage the risk, but also gain from it.

Business Resilience Risk

The main threat to Enel here comes from potentially lower customer volumes through energy efficiency initiatives, on-site storage, or off-grid electricity sourcing. The main risk is to Enel’s retail business, which is directly exposed to any fluctuation in customer demand; retail accounts for about 18% of the company’s EBITDA.

Once again though, Enel’s overall business strategy addresses this risk. First, its networks business earns a regulated return on capital invested, and its renewables business operates under long-term contracts, and both of these present stable earnings streams regardless of volume growth. Second, while the retail business may see an adverse impact from things such as storage and rooftop solar panels, these initiatives will require significant investments in the grid to allow for two-way movement of electricity, and that investment will come from Enel’s regulated networks division. Finally, Enel has invested in its energy services businesses, building them out to offer customers not just energy volumes, but also services to help customers manage their demand and storage capabilities, which offsets lost earnings from lower volumes.

It is important to note that the course of decarbonization is uncertain, and that there is a plausible scenario where electricity demand actually increases as things like transportation and heating are converted to run off of zero-carbon renewable electricity. This represents an opportunity for Enel across its business lines.

Other ESG Risks

We do not believe that Enel faces other material ESG risks among those laid out in our utilities sector framework. Enel has a strong commitment to safety and a track record of responsible asset management to avoid environmental issues, keeping pollution within regulatory-allowed levels. Additionally, while affordability & access is an issue to monitor, Enel generally operates in geographies with strong, independent regulation that resist political pressure to reduce tariffs. We continue to evaluate the company’s various South American operations which is the likeliest location for this risk to emerge, but it does not appear to be material at this time.

Engagement with Enel

We have had extensive discussions with management on decarbonization and how the company’s strategy is aligned to mitigate the risks and benefit from these trends. We have met with Enel’s CEO or CFO at least once per year, with additional engagements with Investor Relations and the company’s ESG team when we are considering how to vote the proxy. We believe that the management is attuned to facing ESG-related challenges and has set stringent, tangible targets for the company, such as exiting coal by 2027 and reducing emissions by 80% by 2030. We have been pleased with Enel’s progress toward these targets, but we will continue to engage with management and push them to continue making progress toward these goals.

- Decarbonization policies and support for renewables can vary widely by state as well

Further information

This document is intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management, LLC (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results. All investments involve risk, including risk of total loss.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. As of September 30, 2021, Enel S.p.A. was held in several of our strategies. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

For U.K. Investors Only:

This document is issued by Pzena Investment Management, Limited (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. The Pzena documents are only made available to professional clients and eligible counterparties as defined by the FCA. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to `wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia. In New Zealand, any offer is limited to `wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (`FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For Jersey Investors Only:

Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC.

For South African Investors Only:

Pzena Investment Management LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029).

© Pzena Investment Management, LLC, 2021. All rights reserved.