A MESSAGE FROM OUR CEO

We at Pzena Investment Management are excited to release our third annual Stewardship Report. While the philosophy underpinning our approach to stewardship has remained consistent, this document is intended to provide updated engagement examples from 2024.

As value investors, we see improvement in business fundamentals as a potential source of excess return. We are therefore focused on the embedded investment opportunity, whether it is the result of improvements in environmental, social, or governance (ESG) issues or any other value drivers. As fiduciaries, we are committed to our stewardship responsibility through direct engagement and proxy voting and believe these are some of the best ways to drive long term shareholder value creation. We seek to engage management on a range of topics, particularly those that are nuanced, and we explicitly favor engagement over divestment.

Two years after creating the Opportunity List1,our proprietary scoring method and enhanced documentation have proven valuable for measuring progress. We have been able to identify tangible outcomes, as indicated by changing ratings and the removal of companies from the Opportunity List once engagement objectives are achieved. Some of these outcomes can be found starting on page 8 of the report.

We also continue to explore various thematic topics through our engagements that can complement our bottom-up company research. We have highlighted some of those themes starting on page 9 of this report.

We hope this report continues to provide insight into how we approach our stewardship activities and how they continue to evolve over time.

CAROLINE CAI

Chief Executive Officer and Portfolio Manager

STEWARDSHIP PHILOSOPHY

At Pzena, our role as responsible stewards of capital has always been an integral part of our fiduciary responsibility to act in our clients’ best interests, maximizing long-term shareholder value.

As value investors, we often find ourselves considering an investment when things have gone wrong, and we rely on fundamental research to assess the likelihood of improvement on these issues. Taking advantage of the gap between a valuation that reflects near-term challenges and the value of the long-term earnings power of the company is at the heart of our investment philosophy. In some cases, the issues or opportunities facing a company fall under the ESG umbrella.

Deep research and extensive engagement can help value investors capitalize on controversy and access this potential source of alpha, making engagement a cornerstone of our investment philosophy and a critical component of our process as long-term active investors.

As we do with all key investment issues, significant ESG considerations are analyzed internally, discussed with company management and industry experts, and monitored. Each step of this process contributes to the team’s determination of whether to invest and, if we do, at what position size. Once an investment has been made, we continue to engage management on an ongoing basis. Through these conversations, along with our proxy voting and other escalation options, we seek to exert influence in a constructive way, oriented toward the long-term success of the company.

ENGAGEMENT APPROACH

We engage with company management throughout our due diligence process, and extensively after an investment is made, on all material or potentially material investment issues. As shareholders, we believe we can help guide companies toward long-term value creation, and we therefore prefer engagement over divestment.

If we determine an ESG consideration to be material to our investment thesis, we raise it with the management team. As each company and management team is unique, our approach to management conversations is organic in each case; however, we always seek an open, cooperative dialogue. We prefer to maintain an ongoing dialogue with company management through regular meetings, in-person site visits, and calls. When we engage with companies, we are typically speaking to some combination of the following: the senior management team, members of the board, an ESG or sustainability lead, and investor relations.

Roles and Responsibilities

For ESG to be integrated into the research process, the industry analyst covering the stock must also lead the associated investment due diligence, of which engagement is a key part. The industry analysts are best placed to evaluate the investment implications of ESG issues, and therefore they bear primary responsibility for discussing these with company management. Our ESG analysts support the industry analysts in such conversations as needed, but we intentionally do not delegate these responsibilities to a separate stewardship team.

Engagement Purpose

Broadly speaking, our discussions with company management have the following purposes in mind:

- Testing assumptions — Engagement is intended to deepen our understanding of issues that we have identified as material or potentially material to the investment. Sometimes we identify these issues at the point of investment, and other times they arise during ownership. In both cases, we discuss the issues with management, solicit their input, assess their response, and evaluate the impact on our investment thesis. To the extent that the issues are ongoing, we continue to follow up until the issue is resolved or no longer relevant.

- Maintaining an informed dialogue — Engagement keeps us apprised of decisions relating to strategic and operational considerations. We routinely meet with management following earnings, strategic business updates, and management transitions.

- Advocacy — Engagement provides an explicit opportunity for us, as shareholders, to advocate for different decisions that we believe will enhance long-term shareholder value. With increasing regularity, companies also proactively seek our input on a range of issues.

The success of each engagement is measured on a case-by-case basis, depending on the company-specific context and goals of the engagement. We kept one or more of these purposes in mind, as we engaged with the companies detailed below.

Examples of Engagement

Globe Life: U.S. Life Insurance

We engaged with Globe Life to address the short-seller allegations that emerged in April and led to a notable decline in the company’s stock value. The short-seller reports alleged widespread insurance fraud within Globe Life’s subsidiary, American Income Life. The alleged fraud included kickbacks on agent training fees, harassment by certain agents/agency owners, disreputable accounting, and lack of timely disclosure around a Department of Justice (DOJ) inquiry related to customer abuse and sexual harassment at a major distribution center for American Income Life.

Globe Life’s independent audit committee hired the law firm Wilmer Hale and the forensic accounting firm FTI Consulting to review the allegations made by the short sellers. As of July 2024, it was determined there was no merit to the accusations of financial misconduct, and no adjustments to the company’s previously issued financial statements were required. Management does not see the short-seller report affecting day-to-day business, and it has not affected the agent recruiting pipeline. As for the separate DOJ inquiry, neither the DOJ nor the SEC has asserted any claims against Globe Life nor indicated that they intend to do so, and management does not believe that it is reasonably possible or probable that this matter will result in a material loss. We will continue to track quarterly and annual KPIs to determine whether there is any lingering reputational damage that could materially affect the underlying business (e.g., agent hiring/turnover, lapse rates).

Given recent stock price weakness, we discussed potential changes to capital allocation priorities, including management’s appetite to accelerate share buybacks. We were pleased that management ultimately decided to take advantage of the share price weakness to the benefit of long-term shareholders. We will continue to engage management on capital allocation plans moving forward.

Gildan Activewear: Global Apparel Manufacturer

We interacted with Gildan’s board and management during the succession conflict that began when the board fired founder Glenn Chamandy in December of 2023 and unfolded in the first half of 2024. After firing Chamandy, the board sought to entrench itself, struck an agreement with a new shareholder for a board seat in exchange for their vote, appointed a new CEO with limited operational expertise, postponed the Annual General Meeting (AGM), and contemplated selling the company at a low valuation. Over this period, we addressed our several concerns about these actions with Gildan.

We had numerous conversations with the board of directors to understand the pattern of acts that led to Chamandy’s dismissal, along with sending a formal letter. From our perspective, Chamandy had a strong track record of operating and managing the business; his leadership and vision were instrumental in designing and building Gildan’s low-cost, vertically integrated manufacturing operations. His strategy was the backbone of the company’s success.

Ultimately, we voted against the board at the AGM and backed a slate comprising of Chamandy and an activist investor. This slate won by an overwhelming majority, and the incumbent board resigned.

OPPORTUNITY LIST

The belief in our ability to push for better outcomes by engaging with the companies we own has been a driving force behind the development and application of the Pzena Opportunity List. The Opportunity List seeks to systematically identify opportunities in our portfolio where material ESG issues exist and engagement could have a positive impact. If we choose to add a company to the Opportunity List, we believe the company has significant room for improvement on material ESG considerations.

After placing a company on the Opportunity List, we create an engagement plan with specific objectives to track progress. In practice, progress against the engagement plan does not typically manifest all at once; it appears in incremental steps over the investment time horizon. If we see a company is trending off-track, we have several options to escalate engagement. Persistent failure to address our concerns could lead to our reevaluation of the investment thesis and potential divestment.

Removal from the Opportunity List may come with the gradual resolution of the ESG issue(s) over time and/or may only require discreet changes, such as the resolution of pending litigation. However, in many cases, removal is more nuanced and requires continuous research, engagement, and monitoring. All investments require us to be in dialogue with management and to respond to changes that may impact the range of investment outcomes.

Opportunity List Example

Vale: Global Metals & Mining Company

Vale was added to the Pzena Opportunity List due to the Mariana (2015) and Brumadinho (2019) dam collapses in Brazil. Our engagements have been focused on the subsequent financial, environmental, social, and reputational losses. MSCI considers Vale to have failed UNGC (UN Global Compact) standards for “impact on local communities,” and the company is on the watchlist for “biodiversity & land-use.” To track these material ESG issues, we will be monitoring the following objectives for Vale:

- Continue an appropriate pace of tailings de-characterizations and associated spend. The company has completed 16 of 30 de-characterizations and expects to finish by 2035, having spent $2.3bn on the estimated $5.0bn program.

- Reach a final agreement with the Federal Public Prosecutors’ Office regarding Mariana reparations.

- Have UN Global Compact Principles fail status removed and/or have no other major disasters in the next two years.

Vale has reached a compensation agreement for impacted communities for both dam failures. To avoid future disaster, Vale has begun a de-characterization program in Brazil. The de-characterization program aims to decommission the remaining tailings containments to reintegrate the structure and its contents into the surrounding environment. This highly technical project is unique to each structure; therefore, Vale must come up with customized solutions for each. The company has now completed 16 of 30 de-characterizations and expects to finish by 2035. Importantly, in 2020, Vale had 35 dams at emergency levels. The company has reduced that figure to 16 and expects to reach nine in 2025.

We believe Vale has improved its governance in the intervening period, and the company has begun to revamp its sites in order to meet new regulatory standards. In addition, Vale has a majority independent board, having added a significant number of industry experts/engineers to the board following the 2019 tailings collapse. Vale also has a fully independent audit committee, which is particularly important from our perspective and is not common in the market. Lastly, with regards to governance, executive compensation is linked to specific ESG goals, such as achieving specific sustainability, safety, and risk management targets, which we believe will incentivize long-term improvement. Although there were rumors that the Brazilian government would attempt to interfere with the company’s CEO search process, the board ultimately independently decided to promote Vale’s CFO Gustavo Pimenta to the CEO role.

Proprietary ESG Ratings

When companies are given an engagement plan, they are also rated from 1 to 3 in accordance with our objectives. A score of ‘1’ is for those companies that have made little to no progress on the objectives we have outlined and/or have not yet acknowledged the issues. A ‘3’ rating is for companies that are making substantial progress in addressing our objectives and/or are highly engaged in addressing the issues. This rating is determined when the engagement plan is created and is reviewed, at a minimum, every six months during our bi-annual Opportunity List review.

Companies that have been classified as a ‘3’ for six months or longer may be good candidates for potential removal from the Opportunity List, although this is not always the case. A company may be rated a ‘3,’ but the issues the company is addressing may take years to resolve, such as capitalizing on opportunities in the energy transition. Conversely, a company may be rated a ‘3’ because the company is addressing a discreet issue, such as lack of a fully independent audit committee.

These ratings allow us to precisely track the progress of names on the Opportunity List over time. Along with monitoring how long a company has remained at its rating, we can measure whether the company is making progress toward our objectives and over what time horizon. This also allows us to evaluate in a timely manner whether we need to escalate our engagement.

ESG Outcomes

We have also introduced explicit documentation and tracking of engagement outcomes for names on the Opportunity List. At every six-month Opportunity List check-in, the research team specifically discusses whether there have been any notable outcomes related to engagements in the prior six months. We do not always expect outcomes, given that some issues take longer to resolve. Tracking outcomes, where they exist, allows us to judge the success of our engagements over time.

Zhejiang Longsheng: Chinese Chemical Company

Originally, Zhejiang Longsheng was added to the Opportunity List with the governance objective to engage and encourage a fully independent audit committee as well as a majority independent board – two important indicators of good governance. Currently, the company’s CFO is a member of the audit committee, which we find to be a major conflict of interest given the responsibility of the audit committee to oversee the integrity of company financials.

Recently, the company has started to show willingness to listen to our concerns, including our request to remove the CFO from the audit committee. Encouraged by our recent discussions, we have upgraded our proprietary rating from a 1 to a 2. The company will remain on the Opportunity List until the CFO officially steps down from the audit committee.

In 2024 we adjusted the ratings for 8 names across various investment strategies to reflect observed progress.

Opportunity List Removals

When a company fully achieves the engagement objectives we outlined, we can remove from the Opportunity List.

Hokkoku Financial Holdings: Japanese Regional Bank

Against the backdrop of Tokyo Stock Exchange governance reforms, we have continued to focus our engagements with many of our Japanese holdings on improving governance to create shareholder value. Over time, we observed Hokkoku proactively improving its ROE to 8% in a challenging banking business environment. The company released excess capital and increased its payout to shareholders while unwinding its cross-shareholdings. Hokkoku has made steady improvements in its board structure as well, achieving a majority-independent board last year. The management compensation scheme has also been revised to be ROE-driven. Together with its effort to reduce fixed costs and improve the business mix, the company’s structural ROE improvement ought to be rewarded. Hokkuku was removed from the Opportunity List in the second quarter of 2024, given these substantial improvements in corporate governance.

Opportunity List

Our Opportunity List provides us with a structure to utilize fundamental research for assessing the likelihood of issue improvements.

THEMATIC ENGAGEMENTS

Modern Slavery

Certain industries are naturally more exposed to risks or allegations of modern slavery than others. The most common industry risk factors include reliance on low-cost labor and opaque and complex supply chains. Industries where these risk factors are more common include engineering & construction, agriculture, and apparel manufacturing, so we pay particular attention to modern slavery when researching companies in these industries. We research and evaluate any instance of modern slavery in other industries as well, even if the common risk factors are not present.

As part of our due diligence, we evaluate company modern slavery disclosures, policies, and procedures, and we proactively engage management to understand how they think about these risks. As appropriate, and where necessary, we also engage management to understand the nature of any allegations of modern slavery and to advocate for changes to a company’s actions.

PVH: Global Apparel Company

We engaged with PVH following reports that China was threatening to put the company on a national security blacklist known as the “unreliables list” for “unreasonable boycotts” of the Xinjiang province. Xinjiang has been the epicenter of alleged human rights abuses against the Uyghur ethnic group. Many consumer-facing brands, such as Nike and H&M, have made public commitments to cease working with suppliers in Xinjiang. PVH has been less publicly vocal about this than peers but made the decision to exit the region because of regulatory risk.

Under the Uyghur Forced Labor Prevention Act, the United States bans goods made in Xinjiang unless importers can prove that they were not made using forced labor or under the influence of the Xinjiang Production and Construction Corps (XPCC), an organization involved with the economic activities of the area. This has led to backlash from the Chinese government, warning multinational corporations that if they comply with consumer boycotts or government bans on products from Xinjiang, they may face retaliation. The penalties vary but could include investment limitation or trade restriction. China makes up approximately 5% of PVH business.

Our engagement with PVH focused on trying to unpack the likelihood of different scenarios. For now, the investigation is ongoing, and, given the sensitivities around the situation, communication between the Chinese Ministry of Commerce and PVH remains private. We continue to monitor the situation and plan to discuss any updates with PVH.

Tyson Foods: U.S. Meat Processer

In September 2023, the New York Times published an article detailing serious allegations of child labor at a Tyson Foods plant in Virginia2. We take allegations of child labor seriously. It is one of two social issues (the other being human trafficking) that we consistently identify as issues to address, regardless of financial materiality. Tyson, along with peers, outsources a large portion of cleaning services to sanitation firms, which allegedly employed underage workers. Tyson does not permit anyone under 18 to work at its facilities and performs audits and spot checks to ensure compliance, but the allegations raised questions of effectiveness and compliance with these policies. Our investment team has maintained a robust dialogue with Tyson on the issue for the last year, albeit limited by the ongoing Department of Justice (DOJ) investigation, which has yet to determine Tyson’s culpability.

Our ongoing engagement with Tyson included discussion of a related shareholder proposal to commission and publish the results of a third-party audit assessing the effectiveness of policies preventing child labor. At first glance, this proposal appeared to be one we would be inclined to support; however, after careful diligence and deliberation, we decided to vote against the specific proposal. Our rationale was that while an independent audit of Tyson’s internal policies and procedures could be beneficial, it was not the right time to conduct one. Tyson was complying with an active DOJ investigation and considering changes to its workforce management oversight. An audit at this point would not yield the desired benefit of measuring the effectiveness of ongoing business practices. Once Tyson formalizes an updated set of internal policies and procedures, it will make more sense to pursue an independent audit. Despite voting against the shareholder proposal, we did encourage Tyson to better engage with proponents of shareholder resolutions in the future to share any differing views more directly.

We continue to discuss allegations of child labor with Tyson as part of our Opportunity List and will monitor the outcome of the DOJ investigation to determine if we can conclude – or need to escalate – our engagement. Tyson’s latest update was that management was working toward bringing a higher percentage of cleaners in-house to reduce the risk of problems in the supply chain.

Energy Transition

The energy transition is relevant to many companies and industries; as such, it remains a key focus of our engagement activities. As market conditions evolve, so too does our perspective on this issue, influencing the way we analyze companies exposed to climate transition risk or with the ability to capitalize on business opportunities arising from the energy transition. The companies we own are either (1) developing products and technologies to capitalize on the transition, (2) reshuffling existing business lines to adapt to a greener world, and/or (3) perceived—wrongly, in our opinion—to be at risk of becoming obsolete, which begets value opportunities.

Arcelormittal: Global Steel & Mining Company

The most material ESG issue for Arcelormittal is its exposure to climate transition risk, given that the steel industry alone accounts for approximately 8% of global carbon emissions. Steel is also one of the most important engineering and construction materials. The question becomes how to decarbonize the steelmaking process while continuing to meet the demand for steel worldwide. This challenge is particularly acute for Arcelormittal, given roughly half of its steel production is based in Europe, where there is significant pressure to decarbonize.

Through engagement, we aim to understand Arcelormittal’s evolving strategy and pressure-test its approach against different decarbonization scenarios. We are tracking whether the company’s stated decarbonization objectives and deployment of green steel technologies remain aligned with climate policy developments, particularly 2026 CBAM implementation in Europe.

We view Arcelormittal approaching the transition in a sensible manner. It has the capital to invest in capex and R&D to develop new green steel technologies faster and at larger scale than its peers. Arcelormittal’s capital spend, both internal growth capex and external M&A, has become increasingly focused on sourcing strategically important green steel inputs (green & blue hydrogen & cleaner feedstocks) and diversifying access to those inputs. Management can also take calculated risks on potentially disruptive technology, such as electrolysis, which separates metallic iron from oxygen in iron ore without any carbon emissions.

The economic challenge of decarbonizing has been a primary concern, particularly because the European steel market is characterized by weak long-term demand and excess capacity that is therefore hard to rationalize. Through carbon taxes, Europe is pressuring steelmakers to rapidly decarbonize their mills, often offering subsidies as incentive. However, to earn a return on this incremental decarbonization capex spend, companies must charge customers higher prices, which we view as unlikely given the unattractive supply & demand dynamics. Arcelor’s management team has come to a similar conclusion. We discussed this with Arcelor’s CFO, who believes capacity in Europe will need to be lower moving forward, relocating production to markets elsewhere. Because Arcelor is a global steelmaker, it has access to steel and raw material production in other geographies where the cost to produce green steel is often cheaper; for example, Brazil and the U.S. have access to cheaper and cleaner electricity, a key input for steel production via the less carbon-intensive electric arc furnace method. This explains why, despite ~50% of Arcelor’s production capacity being in Europe, most of the company’s profits are generated in other regions (i.e., North America, Brazil, and India).

Shell: Global Oil & Gas Major

Under a relatively new CEO, Shell has changed its business and energy transition strategy, which, in our view, now better reflects underlying market realities. Shell lowered the ambition of one of its Scope 3 targets to reduce the carbon intensity of energy products sold, citing increased uncertainty in the trajectory and pace of policies to support the energy transition. Conversely, Shell also introduced a new 2030 Scope 3 emissions target to reduce customer emissions from the use of oil products by 15%–20% (2021 baseline).

Adjustments to the energy transition strategy were interpreted by some as a weakening of Shell’s climate targets and net zero commitment. It is therefore not surprising that a shareholder proposal surfaced, asking Shell to align its emissions reduction targets with the Paris Agreement. The proposal specifically asked for the inclusion of medium-term Scope 3 emissions targets, consistent with the effort to limit global warming to 1.5 degrees above preindustrial levels. This proposal was very similar to one submitted in 2023, which had been rejected by approximately 80% of shareholders. Shell management again recommended voting against the proposal on the basis that targets and ambitions are already in line with the Paris Agreement, and the business is making good progress toward these goals. We ultimately decided to vote against the proposal, as we did in 2023, for the following reasons:

- Shell’s transition plan remains realistic and, therefore, credible. Recent changes to some of the specifics better reflect new market realities, which have moved beyond pure energy transition to include affordability and energy security. Shell’s unique advantage in liquefied natural gas allows it to play a key role in affordability/energy security. Shell continues to make investments in the energy transition where it has a competitive advantage (e.g., carbon capture and storage, biofuels).

- Scope 3 emissions targets cannot be the sole responsibility of Shell, given they are tied to customer demand.

- There is no real authority on what constitutes alignment with the Paris Agreement; it is a judgment call.

- Shell’s responsibility to shareholders requires a balance between meeting emissions reduction targets and maintaining capital discipline, including returning cash to shareholders, which can then be reinvested in the transition if so desired.

Litigation

While legal challenges are not new territory, time and money spent on navigating them is on the rise around the world for boards and management teams. In 2023, companies faced an estimated 57% increase in litigation costs. This seems to partly be the result of a marked increase in third-party-funded litigation. This trend not only underscores the importance of robust governance practices but also highlights the need for proactive engagement with companies to mitigate potential risks.

Bayer: Global Life Sciences Company

Bayer has a few intersecting ESG concerns, which were featured in our 2023 Stewardship Report. One of the original reasons Bayer was added to the Opportunity List was to track and assess litigation payments related to glyphosate and polychlorinated biphenyls (PCBs).

Glyphosate is an herbicide widely used in agriculture and landscaping. Its safety has been an issue for debate, and the plaintiffs’ attorneys have had success linking its use to non-Hodgkin’s lymphoma. As of October 2024, Bayer has won 14 cases, lost 10 cases, and settled ~110k cases for ~$11B. There are ~55k remaining cases in inventory with ~$7B provisioned.

Under new CEO Bill Anderson, Bayer is exploring legislative options to resolve the outstanding litigation. Bayer is working with state (Missouri accounts for 80%+ of glyphosate cases nationwide) and federal legislators on bills that say manufacturers can’t be sued if the label approved by the Environmental Protection Agency (EPA) says the product doesn’t cause cancer.

Bayer faces two batches of litigation: the more prominent Glyphosate/Roundup cases, and the issue of polychlorinated biphenyls (PCBs). PCBs, which were banned in the U.S. in the late 1970s, were a group of chemicals that Monsanto produced and sold to other industrial companies. PCBs were widely used for a variety of applications including fluorescent light fixtures, many of which were installed in schools. In Dec 2021, Bayer lost its first case in Washington state. In May 2024, a state appeals court overturned the original trial court verdict, arguing the trial court failed to properly apply Washington state’s statute of repose. The plaintiff appealed to the state supreme court, which accepted the review. Now that the Supreme Court is reviewing the case, the odds of the original verdict against Bayer being upheld go up. Bayer has been successful in containing these cases to just one cluster in a single school district in Washington state, but this could change depending on the trial outcomes.

We recently upgraded Bayer from a 1 to a 2 on the basis that management is very focused on resolviwng the outstanding litigation, has made progress, and continues to keep a robust dialogue with us on the topic.

Reckitt Benckiser: Global Personal Products Manufacturer

Reckitt Benckiser was a recent addition to our Opportunity List because of ongoing litigation alleging an increased risk of necrotizing enterocolitis (NEC) in premature infants consuming Enfamil formula shortly after birth. NEC is a gastrointestinal disease that primarily affects pre-term infants and has a fatality rate of about 15%-40%.

In March 2024, an Illinois jury awarded $60 million to a plaintiff whose infant died from NEC, finding that Mead Johnson (Reckitt’s infant nutrition subsidiary) was negligent and failed to warn of the risk of NEC. This was the first case in the NEC litigation to be tried. Abbott Laboratories, a competitor of Mead Johnson, lost its first trial in July 2024. There are currently ~1,500 cases filed between Abbott and Mead Johnson. Reckitt argues that the scientific literature is clear on the lack of causality between infant formula and NEC. Specifically, it is the absence of breast milk (which protects better against NEC) that results in a higher incidence rate of NEC among pre-term infants. In early October 2024, various U.S. government agencies issued a joint statement reiterating the importance of formula for pre-term infants, corroborating Reckitt’s argument.

In discussing this issue with medical professionals, litigation experts, and company management, we believe this argument, although backed by the science, may be too nuanced to be effective in a jury trial setting, which widens the potential range of outcomes in the courtroom. Nevertheless, it is our assessment that Reckitt Benckiser has a good chance of limiting the size of its ultimate financial liability with the scientific evidence on its side. Most recently, the third NEC case to go to trial (in October 2024) resulted in a not guilty verdict for all parties involved. The next NEC trial scheduled will be the first of four bellwether cases in the federal multidistrict litigation (MDL), which will be heard in May 2025. The evidentiary bar for federal MDL pretrial proceedings is much higher, which should work in Reckitt and Abbott’s favor. We expect this trial to provide greater insight into this issue as we move forward.

Our engagement objective is to continue to track and assess NEC litigation-related strategy and payments. The Reckitt stock is cheap even assuming a fairly draconian ultimate liability related to NEC.

ADDITIONAL ENGAGEMENT TACTICS

Engagement Escalation

In instances where issues have not been adequately addressed during our routine engagement with management teams, we may consider the following actions to escalate our concerns:

- A private meeting with the chairman or other board members

- A written letter to members of the senior management team and/or board members

- Voting against members of the board or resolutions at annual general meetings

- Divestment if the lack of progress changes our view of the investment embedded risk-reward

Hooker Furniture: U.S. Furniture Company

In April of 2024, we wrote a letter to furniture company Hooker’s Board of Directors encouraging a share buyback program. From our perspective, Hooker was being overly conservative with its balance sheet and should have been redeploying capital for a potentially higher return. We wrote the letter to formalize our recommendations after several in-person conversations with management in which they agreed with our assessment.

Collaborative Engagement

While we typically prefer to engage directly with the companies we own, occasionally we recognize the potential benefits of collaborative engagement with other investors. In such cases, we may seek to work with other investors, but we will only do so when we believe it is in our clients’ best interests and permissible under applicable laws and regulations.

Situations where we have found collaborative engagement helpful include, but are not limited to, advancing a shared agenda with clients for a particular portfolio company and/or working with other investors to share insights on a particular issue.

Haier Smart Home: Chinese Home Appliances & Consumer Electronics Company

We spoke to various other investors and stakeholders, as we were deciding how to approach a corporate governance issue at Haier Smart Home. Haier does not have a fully independent audit committee, and it is our view that a fully independent audit committee is one of the clearest indicators of good governance, because it has the strongest connection to company performance of all governance metrics in the academic literature. We examine this link in our thematic research piece, Assessing Corporate Governance. When we engaged with Haier management, they told us that we were the only investor with this concern. We decided to speak to other asset managers who are also shareholders of Haier to understand how they were thinking about audit committee independence. We learned that other asset managers did indeed have different priorities for their engagement with Haier, sometimes influenced by the view that Haier was unlikely to change the composition of the audit committee. This did not change our own conviction in ongoing engagement, but it meant we could not amplify our voice through shared messaging with other like-minded investors.

There are also aspects of collaborative engagement efforts that are less well-aligned with our approach and investment philosophy. First, we do not seek to become activists or insiders, nor do we encourage proxy battles. Instead, we prefer to maintain a constructive dialogue with management teams and work collaboratively to achieve the desired outcome. Second, company-specific, bottom-up, ESG-integrated investment analysis is core to our investment philosophy and approach to stewardship. This naturally lends itself to a more company-specific approach to engagement. The perspective we want to bring to management teams is often more nuanced than some collaborative organizations allow. As such, we have not necessarily found collaborative engagement initiatives particularly helpful to advance our agenda with company management. If we were applying ESG themes top-down, it might make more sense to team up with other investors focusing on the same ESG theme. We also find we maintain good access to management teams through our concentrated portfolios, so we have not needed to leverage these collaborative groups for the purpose of seeking an audience with management teams.

That said, we do periodically consider membership of other stewardship and engagement focused organizations and remain open to evolving our approach. Our ESG team has evaluated Climate Action 100+, the IIGCC, Ceres, CII, and the UK Stewardship Code for potential membership. While we have no plans to join any of them at present, we keep them on our radar and remain open to joining any of them in the future. Our ESG team also spends significant time engaging with the ESG community through panels and other means. As members of the Principles for Responsible Investment (PRI) and International Financial Reporting Standards (IFRS) we frequently attend convenings with other members.

Policy Related Engagement

ESG issues often become financially material for companies and industries because of regulation. As such, it is important to maintain a dialogue with policymakers as part of our research and stewardship activities. In the past year, we have engaged on many regulatory matters, including the Inflation Reduction Act (IRA), the EU Green Deal, and the ‘Fit for 55’ package, as well as Japanese and Korean stock market governance reforms.

PROXY VOTING

Proxy voting is a critical component of our engagement efforts and ability to drive change. As such, we take our responsibility as stewards of our clients’ capital seriously, actively voting the shares of companies in which we invest on their behalf as an integrated part of our investment process. Each proxy is voted in what we believe to be the best interests of our clients. We exercise proxy voting to highlight our views on management decisions, including ESG-related items, regardless of whether we agree with management’s recommendation. We evaluate each proxy item for any investment on its own merit and therefore vote on a case-by-case basis, informed by our Proxy Voting Policy.

Institutional Shareholder Services (ISS) provides us with a proxy analysis including supporting research and a vote recommendation for each shareholder meeting. Nevertheless, we retain ultimate responsibility for instructing ISS how to vote proxies on behalf of each individual proxy item for each company

We disclose our proxy voting records publicly, and they can be found AT THIS LINK.

Roles & Responsibilities

Each proxy is reviewed and voted by the industry analyst covering the stock. We intentionally do not outsource this responsibility to a separate stewardship team, as we consider it a fundamental part of our investment due diligence and engagement. Our Director of Research is responsible for monitoring analyst compliance with voting procedures.

The ESG team assists the industry analyst in making a vote determination, primarily on ESG items where either the specific issue falls outside of the scope of our policy, or the industry analyst desires additional guidance.

Significant Proxy Examples

Travis Perkins: UK Building Products Distributor

One of the more important votes we cast for companies every year is for the individuals that comprise the board of directors. The board, unlike company management, is primarily elected directly by shareholders to help protect their interests and oversee company management. It is therefore important that the individuals on the board possess the right combination of skills and experience to play this role effectively.

In the case of Travis Perkins, we believed the board had not been effective in its execution of management oversight and decided to vote against the chair. We were concerned with opaque decision-making related to poor capital allocation and abrupt management change in response to operational underperformance. (The former CEO left abruptly without an identified successor in place.) Additionally, we believed the business would benefit from a chair with more relevant industry experience to help the company navigate through a challenging period. We appreciated the chair’s decision to step down following the vote, as 23.6% of shareholders opposed his re-election.

Thus far, we are pleased with our engagement with the new board chair, who has relevant experience in the building products industry. It is important during this period of underperformance that the board can identify areas for improvement as well as sources of competitive advantage. We believe the new board chair is better positioned to do this effectively.

Nippon Light Metal: Japanese Metal Manufacturers & Seller

Encouraging good governance has always been a key part of our engagement with the management teams of companies. Poor governance may lead to diminished return on capital for shareholders over time. Historically, Japanese companies have been slower in adopting some best practice governance standards, and this has been reflected in lower market returns.

In the first quarter 2024 newsletter we highlighted the progress of governance reform in the Japanese market guided by the Tokyo Stock Exchange (TSE). We showcased some exciting opportunities in our Japanese portfolio where governance improvements had begun to materialize. We have continued to see positive governance changes among a few names, including a recent improvement in board independence at Nippon Light Metal.

We have maintained a dialogue with Nippon Light Metal regarding the lack of a majority independent board. As previously mentioned, academic evidence shows that board independence can be an important indicator of good governance, linked here. Nippon Light Metal recently brought in two new independent directors, creating a non-management majority with a total of four insiders and five outsiders. In addition, Nippon Light Metal shrunk the board from fourteen to nine members, which we also view as a governance improvement because larger groups are more likely to be less efficient decision-makers. As a result of these changes, we voted in support of all the board members up for election. It is encouraging to see significant governance improvements at the company level. The TSE reforms are a top-down directive, but real change will only come from companies implementing changes from the bottom up. We will continue to monitor changes in the Japanese market and engage with all the companies we own.

Hankook Tire & Technology: Global Tire Manufacturer

Stronger governance and greater transparency to shareholders have been the guiding objectives for our engagements with Hankook during our ownership. Specifically, we have focused discussions on capital allocation decisions as well as compensation policies. After voting for a reasonable compensation package in 2023, we voted against an above-market compensation plan in 2024.

Most recently, we were disappointed to see that board member HB Cho was up for nomination at the company’s AGM. HB Cho has been convicted of accepting supplier kickbacks and is currently being indicted for issues regarding related-party transactions and misuse of corporate assets. We, along with other shareholders, expressed concerns about HB Cho’s appointment to the board, and he was ultimately removed from the ballot ahead of the AGM. We view this as a successful engagement because we secured the outcome that we believe to be in the best long-term interest of shareholders. We will continue to monitor any future governance changes.

ENGAGEMENT BREAKDOWN

Geographic location breakdown for all engagements in 2024

location is based on the where the headquarters of the company are

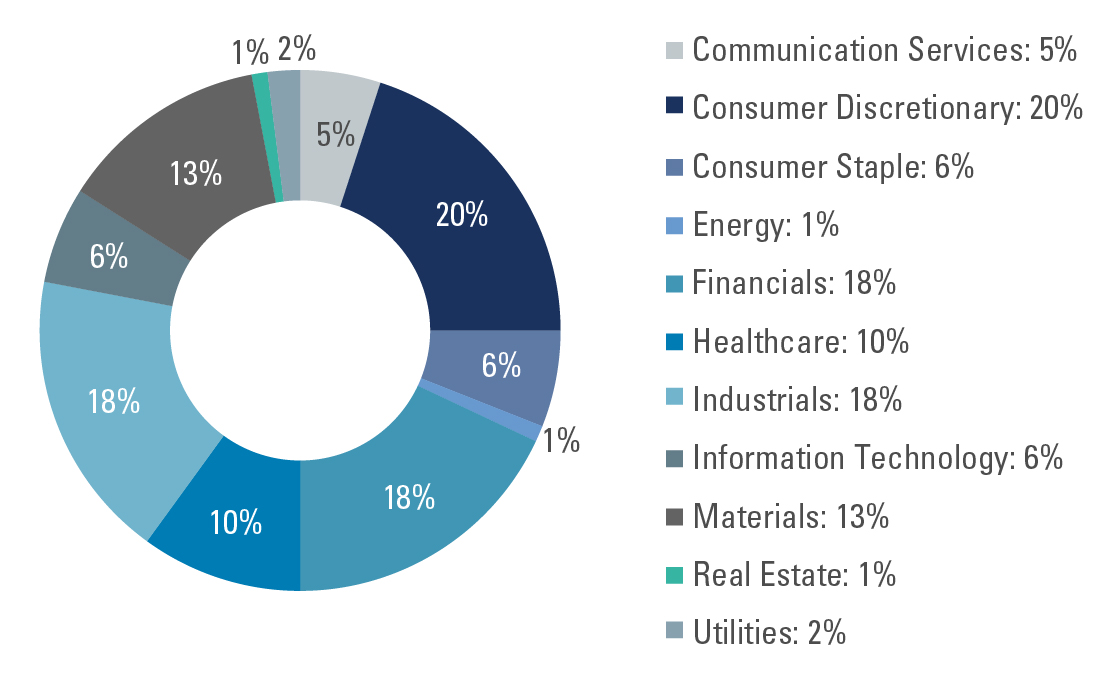

Sector breakdown for all engagements in 2024

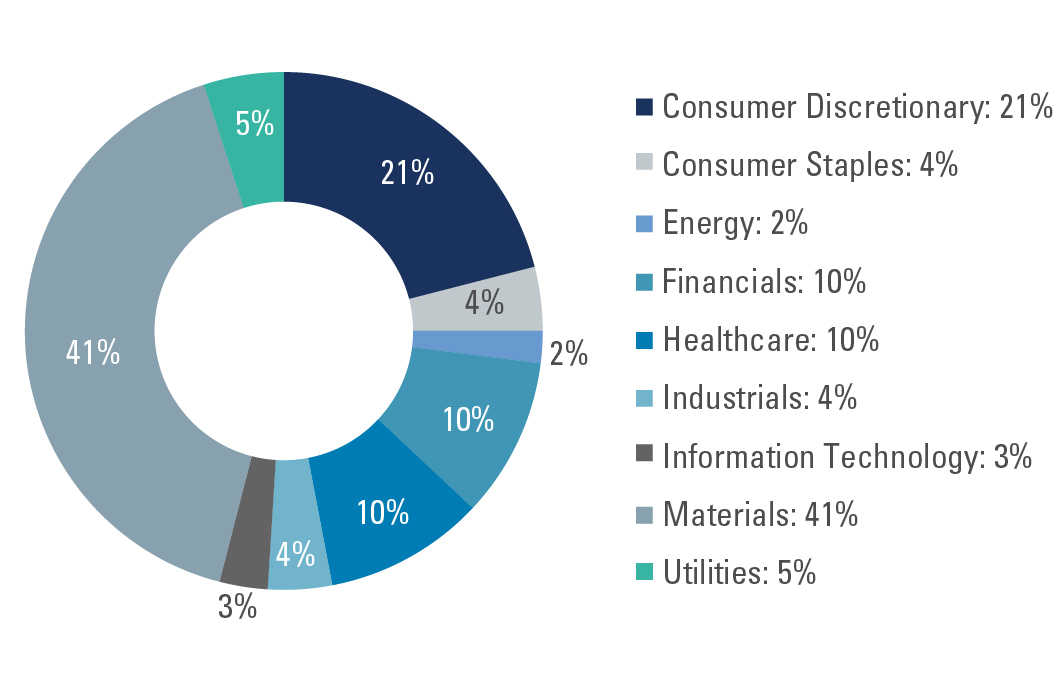

Sector breakdown for all Opportunity List engagements in 2024

E, S & G breakdown of Opportunity List engagements

overlap due to multiple topic meetings

-

The Opportunity List is a portfolio specific set of names that seeks to systematically identify opportunities where material ESG issues exist and engagement could have a positive impact and improve financial outcomes for investors. Details of the Opportunity List can be found here

-

Source: https://www.nytimes.com/2023/09/18/magazine/child-labor-dangerous-jobs.html

Further information

These materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management, LLC (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results.

All investments involve risk, including loss of principal. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

For U.K. Investors Only:

This marketing communication is issued by Pzena Investment Management, Limited (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Vittoria & Partners LLP (FRN 709710), which is authorised and regulated by the Financial Conduct Authority (“FCA”). The Pzena documents have been approved by Vittoria & Partners LLP and, in the UK, are only made available to professional clients and eligible counterparties as defined by the FCA.

For EU Investors Only:

This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia.

In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For Jersey Investors Only:

Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC nor the activities of any functionary with regard to either Pzena Investment Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998.Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998.

For South African Investors Only:

Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029).

© Pzena Investment Management, LLC, 2024. All rights reserved.