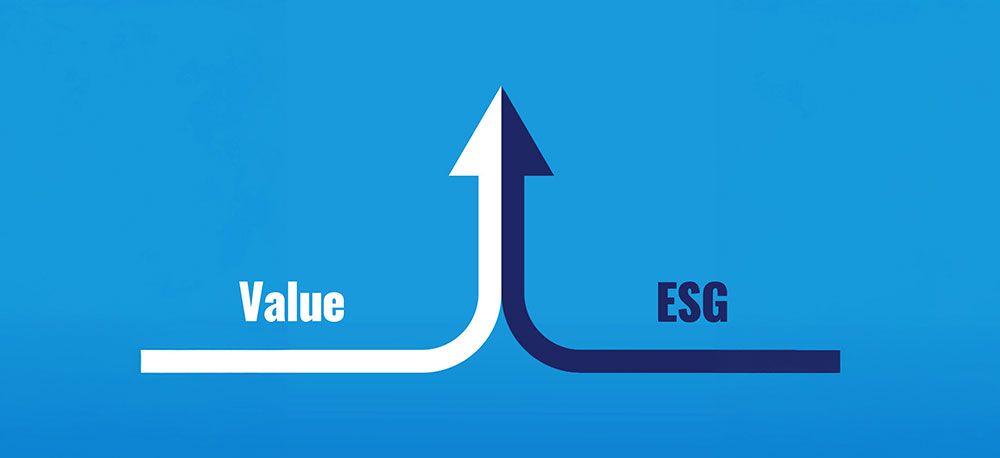

Value Investing and ESG

ESG Integration means fully understanding the value opportunity at stake for a given company.

| Value Investing | Relationship indicator column | ESG Integration |

|---|---|---|

| Temporary Difficulty | ||

|

Investments are experiencing temporary difficulty |

|

ESG controversies can be a material driver of temporary difficulty |

| Opportunity | ||

|

An opportunity to buy a good business ‘on sale’ |

|

ESG laggards may have an embedded opportunity to improve |

| Long-Term Perspective | ||

|

Requires patience / long investment horizon |

|

Many ESG issues require a long-term perspective |

| Alpha Potential | ||

|

Earnings recovery = source of alpha potential |

|

ESG improvement = source of alpha potential |

ESG Integration

ESG integration is an inherent part of our dedication to finding value. As long-term investors, we use our influence to improve company ESG performance when the issues are material to investment outcomes.

Our Research Process

Our commitment to incorporating ESG into our investment process drives us to continually enhance the way we look at ESG issues. For a detailed explanation, review our comprehensive ESG Investing Approach.

Engage With Management

Monitor

changes that may influence conclusions.

Identify

stock-specific ESG issues.

Analyze

financial materiality of ESG issues.

Evaluate

ESG impact on future normal earnings.

Opportunity List

Our Opportunity List provides us with a structure to utilize fundamental research for assessing the likelihood of issue improvements.

Initial Screening

1. Identify

Naive screening criteria help identify where material ESG issues exist.

Fundamental research may uncover additional ESG issues.

2. Assess

Research analyst assesses ESG issues with support from the ESG team.

Final Review

3. Deliberate

Preliminary engagement plan with specific objectives discussed. Portfolio managers, the research analyst, and the ESG team decide whether to add a name to the Opportunity List. For names added to the Opportunity List, engagement plan is finalized and proprietary rating from 1-3 assigned.

Post-Buy Decision

4. Monitor and Engage

Research analyst is responsible for ongoing engagement. No finite timeline for engagement or removal from the Opportunity List.